Class 8 - Debunking lies (FUDs) about Bitcoin

🎥 Class Video

👉 Click here to watch on YouTube

Full Script

Class 8 - Rebutting lies (fuds) about Bitcoin

Ever since Bitcoin first appeared, lies have been created to try to convince people that Bitcoin is just no good. In Bitcoin circles, these lies are known as FUDs.

FUD stands for Fear, Uncertainty and Doubt. These are narratives purposefully created to make people afraid and turn away from Bitcoin.

In this lesson we'll uncover the main lies told about Bitcoin and the narrative attacks used to prevent people from becoming interested in, studying and owning Bitcoin. The idea is that by the end of this class you'll be aware of them so that, when these FUDs appear, you'll know that they're just nonesense. And there's no shortage of FUD gripping their claws into Bitcoin. After all, if there's no way to stop the Bitcoin network, the alternative for defenders of the fiat system is to generate fear.

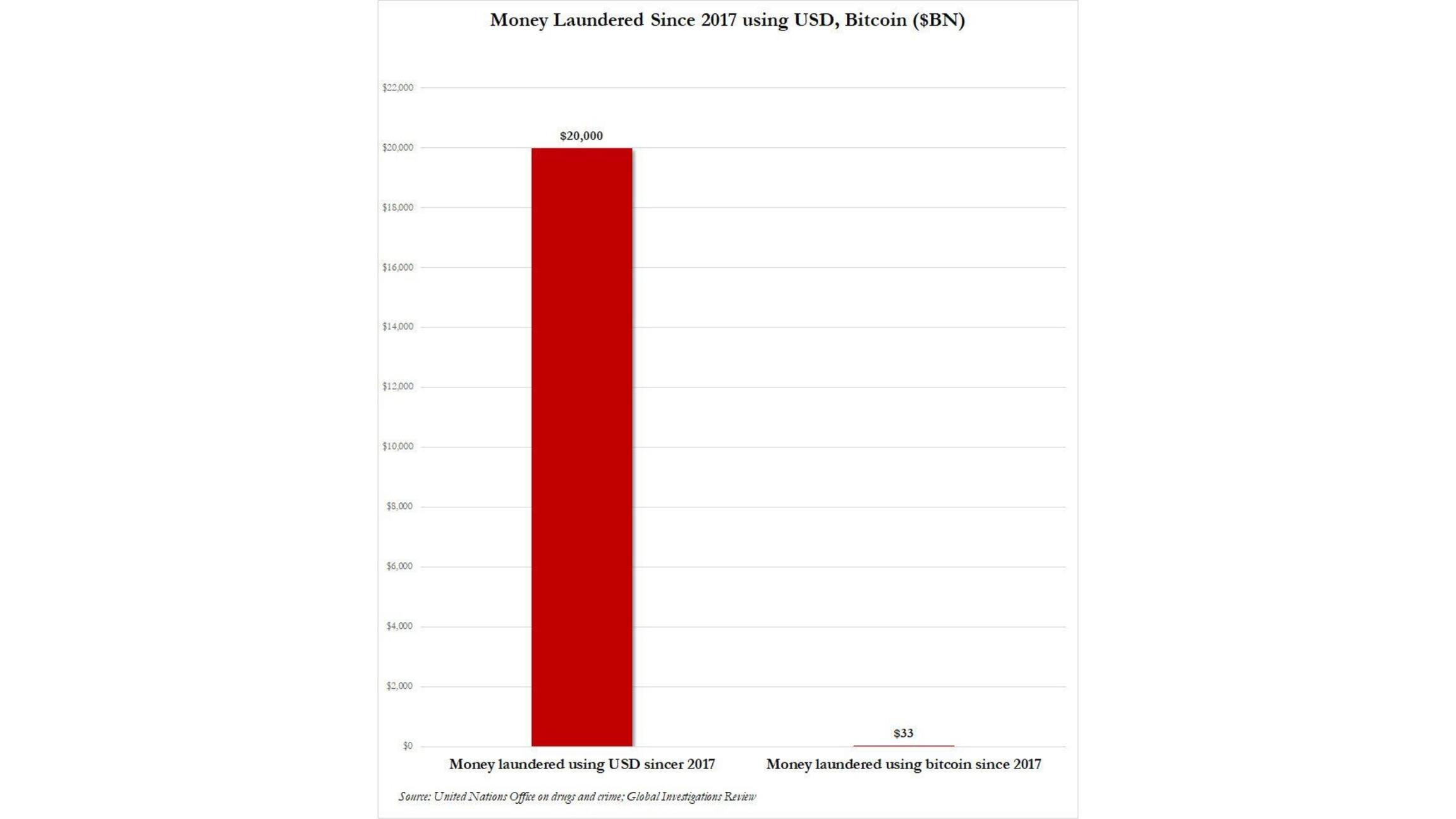

The first big FUD is that Bitcoin is used by criminals to commit crimes and illegal acts, such as drug trafficking, money laundering and even terrorism. Thinking like that, you'd think it was Bitcoin that caused crime to explode! All of these problems existed before Bitcoin. Do you know what is used much more frequently to commit crimes?

Yes, the very own fiat money created by central banks, such as the dollar, for example. Most police seizures involve bags and bags of cash. And yet people don't blame the central bank for crimes using government money. Why do they end up blaming Bitcoin?

Criminals will use anything of value to commit crimes. Bitcoin, paper money, wine or gold bars are not to blame. Being used for crime doesn't take away from the value of these assets and currencies. Just as no one blames or forbids knives for murders. The knife is just a tool that can be used for both good or evil. Bitcoin is also a tool.

The problem is the crime committed -- and that is what needs to be investigated and sanctioned. Bitcoin, like gold, is neutral. You can use it to fund an orphanage, donate to charity or fund a gang. It is the use that determines whether the intention is good or bad, not the tool.

It has also been proven countless times that criminals mainly use banks to launder illicit money. A report by FinCEN Files showed how banks processed more than 2 trillion dollars in suspicious criminal transactions. Even the world's largest banks, such as Deutsche Bank and JP Morgan, were on the list of entities that processed criminal transactions between 1999 and 2017.

In the end, they merely paid a fine and continued operating.

There's even a documentary showing how HSBC facilitated the laundering of money from drug cartels in Mexico. In other words, banks have always processed money from criminals, terrorists, drug trafficking and so on. But they blame it on Bitcoin.

This research by Elliptic shows how at the beginning of the Bitcoin network around 35% of transactions had illicit origins. But as it became clearer that the Bitcoin network is transparent and there is no way to delete transactions after they have been broadcasted, criminal usage of the network decreased. Today, less than 1% of transactions have an illicit origin. After all, no criminal wants to produce indelible evidence on themselves. Today this type of use in Bitcoin is way less common than with the dollar and the banking system.

Since 2017, around 2 trillion dollars have been used for illicit activities, while 33 billion dollars in bitcoin have been used to commit crimes. The dollar is used 60 times more than Bitcoin for illicit purposes and 3 to 5% of dollar transactions are used to finance crime. Whereas Bitcoin doesn't even reach 1%.

This is what the Chainalysis study shows. Less than 0.34% of cryptocurrency transactions in general (shitcoins) are used for crime.

Even within this 0.34%, the majority still prefer to use stablecoins, in the yellow column. In other words, criminals would rather use dollar stablecoins than Bitcoin to commit crimes! By 2022, Bitcoin no longer was the main way for criminals to collect money compared to cryptocurrencies in general.

That's why saying that Bitcoin is a favorite among criminals is really something said by people who don't know what they're talking about. They're just reproducing a lying narrative they've heard. Bitcoin is way less used by criminals than dollars or even stablecoins.

The next FUD is well known: Bitcoin is a bubble!

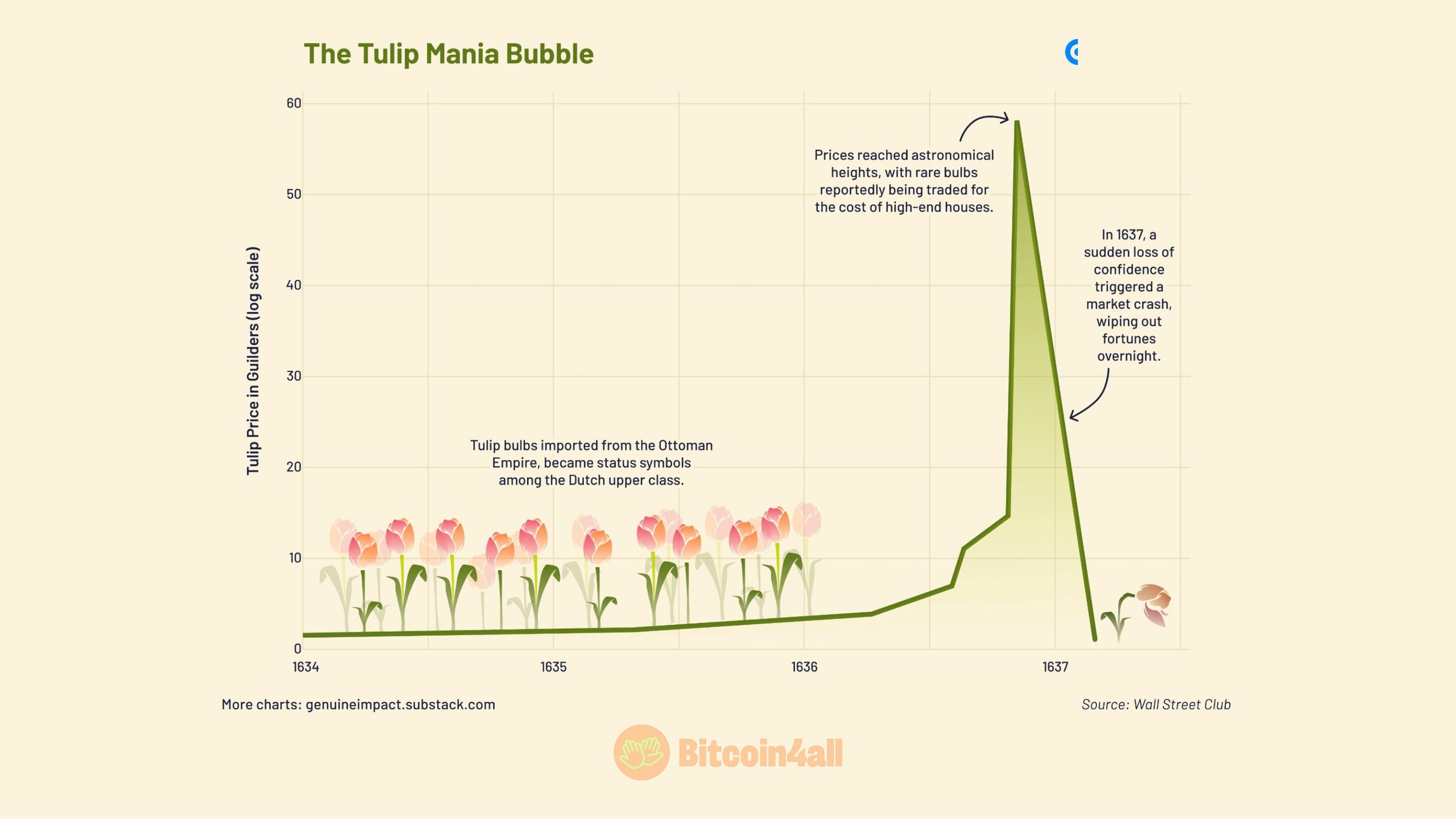

Financial bubbles happen when assets increase in value too quickly and unsustainably.

They end up bursting when investors notice that prices are much higher than the fundamental value of the asset. Bitcoin is often compared to the "tulip fever", which is said to have taken place in 17th century Holland.

The story of the tulips in Holland is very famous and describes how from one moment to the next the price of tulips began to rise sharply. Then everyone, thinking it was a good deal, started buying tulips, which caused the price to rise even more, leading to a state of general euphoria.

When people realized that tulips were a plant and that they retained no value whatsoever, they started selling and the price plummeted. The tulip bubble took a little over three years to collapse, from 1634 to 1637. Many people saw their money melt away. There are those who say that this story never happened and that it's actually a metaphor to explain how financial bubbles work. Either way, tulips are still mentioned today; when someone calls Bitcoin a "tulip", they are referring to this story.

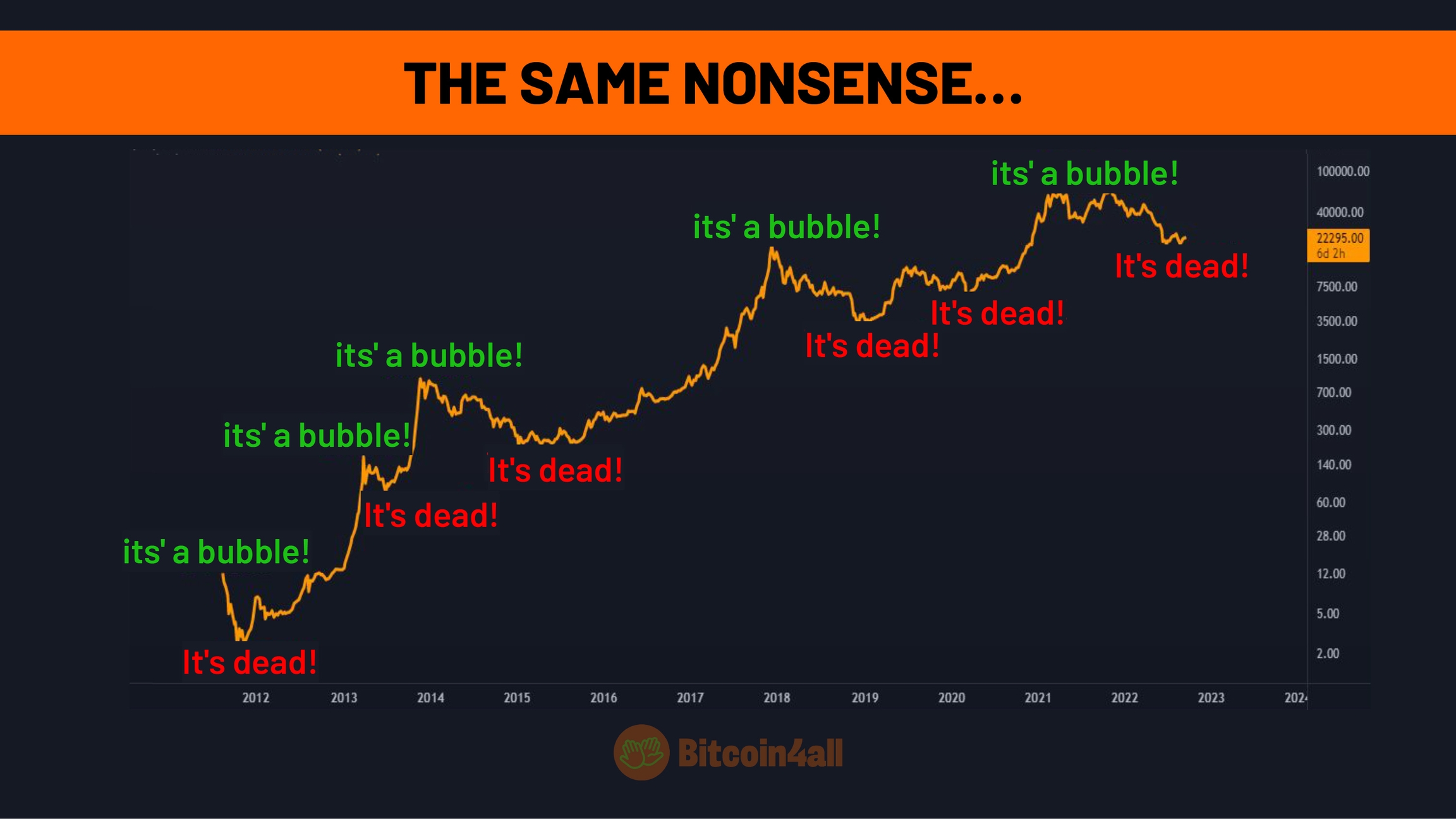

Defenders of fiat like to post this image to try to compare Bitcoin with other bubbles of the past, showing how it made a similar movement to the tulip bubbles (in red), the Mississippi bubble, the South Sea bubble and so on... But what they don't show is this image right here.

The reality is that Bitcoin has gone through several cycles over 16 years and has always recovered, breaking new record highs with each passing halving. The higher it rises, the more difficult it is for it to go to zero, as many say is so easy to happen. This is not the case with real bubbles. Once they collapse, they never return to their higher value.

Those who compare Bitcoin to bubbles aren't paying attention to Bitcoin's cyclical movements and this kind of comment only exposes their lack of understanding of the subject. Once you update the chart, you realize that Bitcoin continues to appreciate even after over 16 years of being called a bubble.

Bitcoin moves in cycles of appreciation that take it to ever higher levels. Every time it falls or rises, there's always a skeptic to say that Bitcoin is dead or that it's a bubble. The thing is that Bitcoin never dies and the bubble never bursts.

Bitcoin's price curve actually reflects its adoption curve growing year after year.

Another common FUD is when people say that Bitcoin has no real use. People might say that, unlike gold, which is used to make jewelry, Bitcoin has no use in the physical world and is therefore worthless. If it's not tangible, then it's worthless.

That's another piece of nonsense. The digital world is increasingly overtaking the physical world. Companies now have websites and social networks, banks have closed more and more physical agencies and now have apps, newspapers have stopped being printed and now publish on websites. To discredit Bitcoin just because it doesn't exist in the physical world is to turn a blind eye to the digital transformation that has been taking place in the world for decades!

Being digital further amplifies Bitcoin's properties as money. The fact that Bitcoin has no other secondary use in the physical world is also not a disadvantage. Gold became money after centuries of competition with other metals, less scarce and with inferior monetary properties. Its use as adornment and decoration was a case of its use as a demonstration of wealth and power, not as a seal of monetary property. A fact that had already been proven centuries before.

Bitcoin doesn't need to hang around someone's neck to have value and Bitcoin's digitality doesn't disqualify it as money. Given that money is a tool that everyone needs to make exchanges and preserve value, Bitcoin fulfills this role much more efficiently and usefully than any other money in history precisely because it is digital and easier to verify and transport.

The fourth FUD is that Bitcoin has no intrinsic value. Although Bitcoin is not backed by a physical asset like gold, it is worth noting that the dollar, the euro and any other fiat currencies are not backed by gold or other asset or commodity.

Bitcoin's value lies in offering -- for the first time -- an alternative, decentralized financial system that cannot be corrupted, inflated or monopolized by anyone, not even governments.

Bitcoin is backed by its unique properties offered by no other asset. Bitcoin is backed by itself. Now that is intrinsic value. This talk of intrinsic value just shows how those who say this don't even know how fiat money works and attack Bitcoin out of sheer ignorance.

Gold relies on its atomic properties; they are exactly what guarantees that gold will not change. Gold is its own backing as well. Nobody asks what is gold backed by, do they? Through cryptography, proof of work and p2p networks, Bitcoin digitizes and amplifies the monetary properties initially offered only by gold, now available in an even better form. That's what gives it value.

As its own backing, Bitcoin is a digital gold and that's why in the future it tends to be the underlying asset for everything, just as gold did in the past.

The fifth FUD is classic: Bitcoin will be replaced by a better competitor!

Millions of cryptocurrencies have emerged, none of which has come even close to overtaking Bitcoin in market capitalization or fundamentals. Despite the great competition, it is becoming increasingly clear that decentralization and the discovery of digital scarcity are unique events in money. No matter how they try, no one can replicate it.

Do you still have doubts about this? There are more than 5 million cryptocurrencies. All of them work just like companies and not as a decentralized protocol. As Michael Saylor says: "There is no second best".

The 6th FUD being spread around is that Bitcoin is a game of chance, just pure speculation. Many people treat Bitcoin as something you buy when it's low and sell when it's high. Generally, people who do this end up taking a lot of trouble trying to guess the price's top and bottom. Those who treat Bitcoin as a speculative asset are the ones who lose the most money.

Bitcoin is a new financial system currently being monetized. It's a public, transparent network; everything that's going to happen in its policy is known more than a hundred years in advance. It's the opposite of a casino, where the house usually wins and has no way of auditing the machines or infiltrating the management of the business. Casinos are obscure while Bitcoin is transparent.

What's more: anyone who buys Bitcoin and holds it for at least four years doesn't make a loss on it. That's what this image shows:

Those who don't speculate and hold for at least 4 years don't make a loss with Bitcoin. It has remained positive 99% of the time; only those who bought at the top and sold are negative. As Bitcoin appreciates, those who bought at past tops become positive too. This has been the case ever since Bitcoin began circulating.

Those who constantly accumulate with a long-term focus move out of speculation mode and into savings mode, treating it as a store of value -- just like what was done with gold in the past. Nobody keeps casino chips for the long term, but people do store gold. That's the difference. Crypto tokens and casino chips are speculative, led by an expectation that they will quickly be converted into more fiat.

With Bitcoin, the focus is on accumulating as much as possible now, because we know that in the future it will be way more difficult, if not impossible, to accumulate in this price range. People save Bitcoin not to convert it into fiat, but because all the value in fiat is being converted into Bitcoin, which is a new monetary denominator.

That's why Bitcoin is not a game of chance, but rather a game of luck: the luck to still be able to accumulate at such an early stage of adoption and value.

The 7th FUD is the notion that Bitcoin isn't safe. People go around spreading the word about how it can be hacked, that governments can shut it down, that Satoshi will come back and wipe out the network.

Many of the misconceptions about Bitcoin's security come from the fear due to attacks on exchanges and other platforms that use Bitcoin, and not from the Bitcoin network itself. Bitcoin has worked securely and non-stop 99.9% of the time since it began trading in 2009. No centralized network has an uptime like that.

The security of the Bitcoin network is guaranteed by an immense computing power. Miners and nodes are distributed all over the world and there is no single point of failure to attack.

Anyone who says that Bitcoin isn't safe hasn't stopped to study Bitcoin and is comparing it to centralized models that have nothing to do with Bitcoin. In 2024, for example, there was a global Microsoft blackout. Banking systems and social media platforms were shut down globally.

Centralized platforms have proven that they can be censored or shut down by hackers or bugs. Bitcoin has been running non-stop for 11 years while all these platforms have had some kind of blackout.

And finally, the 8th FUD: that Bitcoin is harmful to the environment. Have you ever heard anyone say that Bitcoin is bad for the planet, that it uses too much energy and that it should be modified or stopped altogether? This controversy couldn't be left out of this lesson.

This has been one of the biggest lies of recent times scaring people away from Bitcoin. The very first point to understand is: is energy usage a problem?

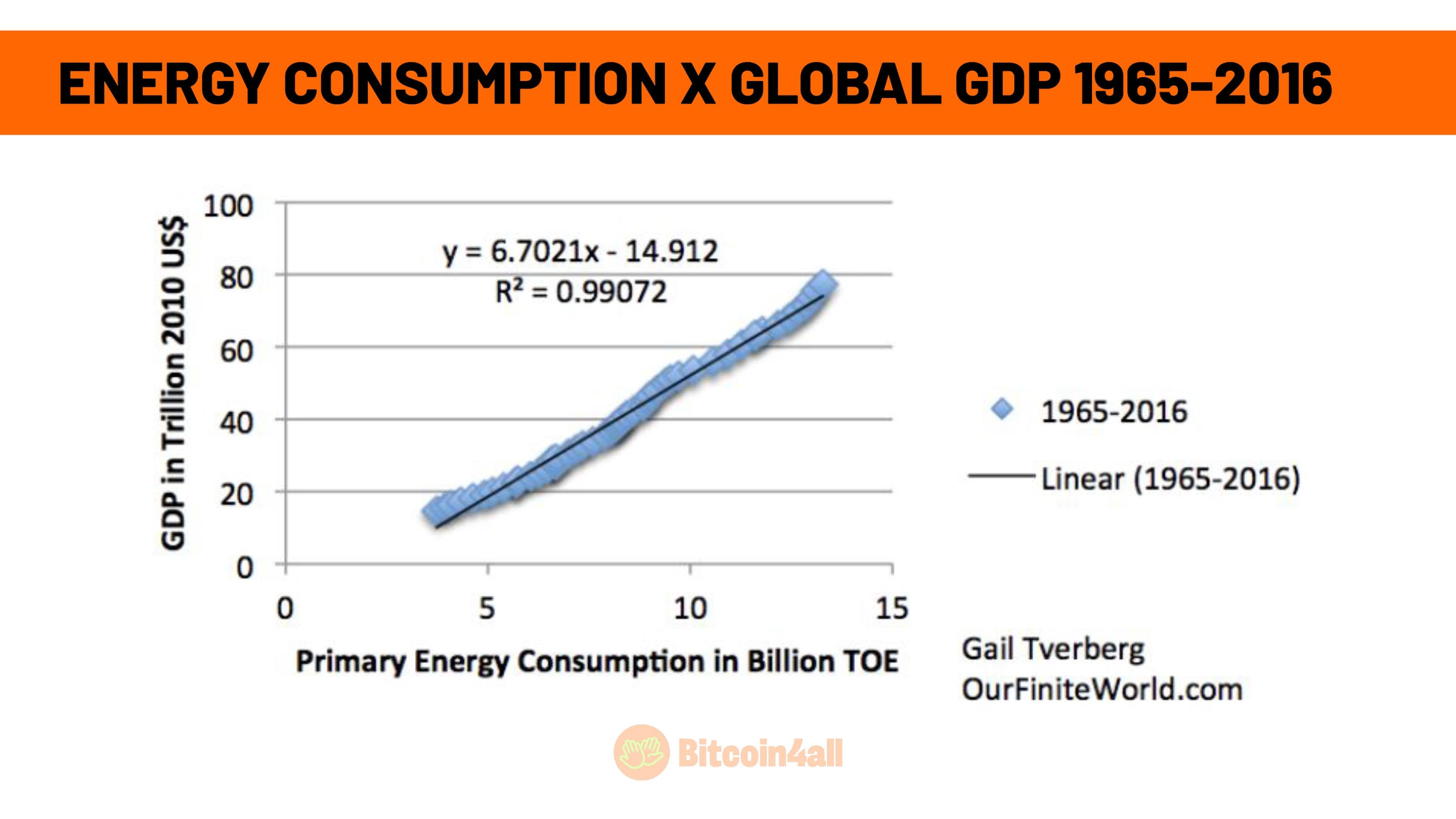

A very interesting fact is that energy and its usage is totally correlated to the level of civilizational development. This graph shows that as global GDP has grown, so has energy consumption.

As time goes by, we as a civilization tend to use more energy, since this energy is converted into technological, human, health and production advances that help us evolve. Or would you rather go back to the caveman days, barely using any energy, but facing a world of trouble? I didn't think so...

This image also shows us that the richest and most developed countries consume the most energy. Poorer countries with lower salaries consume less. Notice that the use of energy is totally correlated to human development. So much so that there is a scale to measure this: the Kardashev Scale.

This scale suggests that civilizational progress is based on consuming more energy, not less. The Kardashev scale is measured in watts and states that there are different classifications of civilization types according to their degree of mastery over energy sources. Here on Earth, for example, we haven't even become a Type I civilization, which dominates all the energy sources on the planet itself.

Type 2 dominates the energy sources of its solar system. Type 3 dominates the energy sources of its galaxy. In other words, if we want to evolve as a species, we'll need more energy, not less. So spending more energy isn't a problem in itself, it's an evolutionary necessity.

So if using energy is natural and necessary, what's the issue? The actual problem is how this energy is produced and how to produce energy -- and Bitcoin -- efficiently.

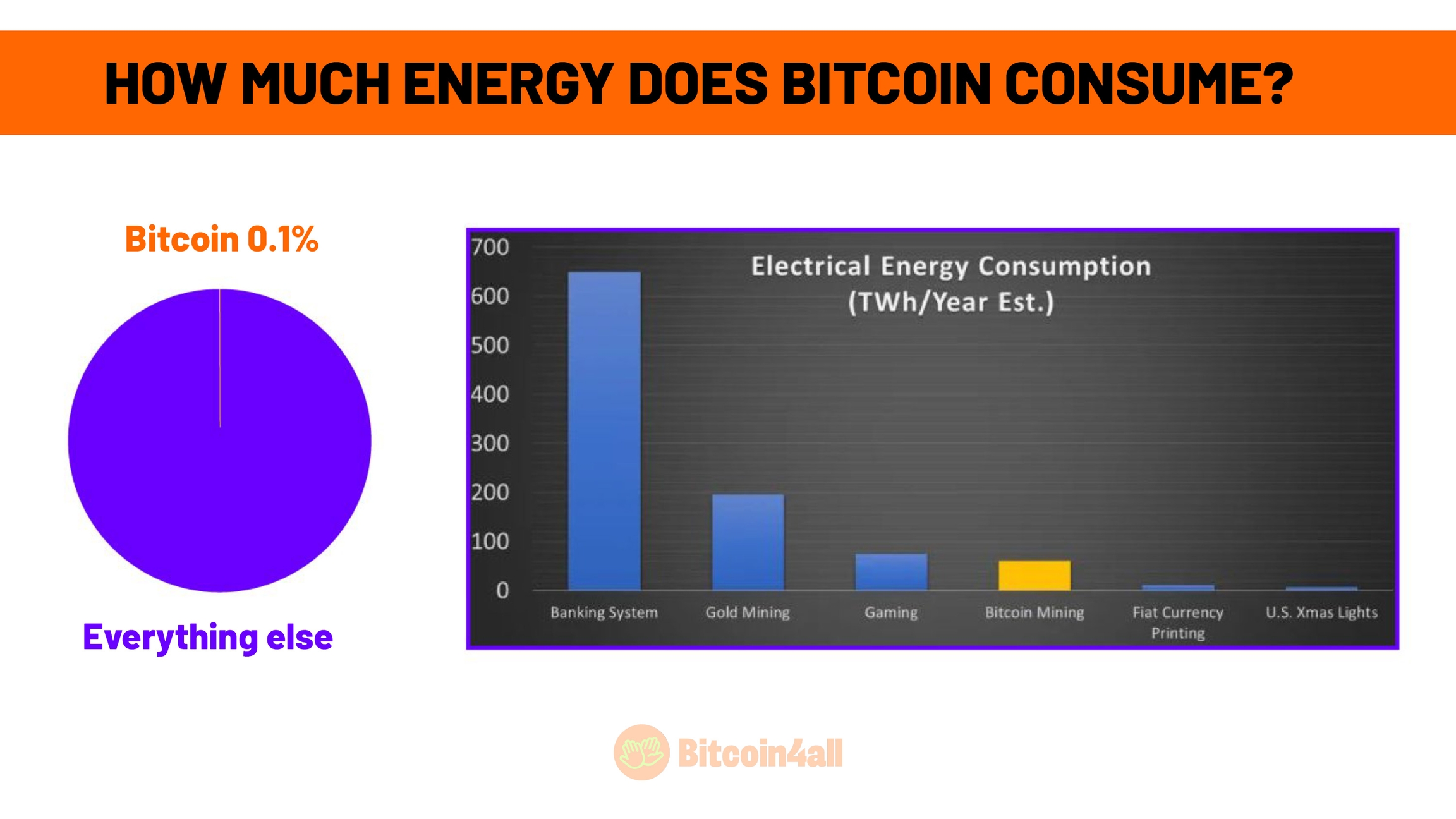

In general, Bitcoin consumes a lot of energy, around 70.4 TWh per year. However, compared to other industries, it's still a fairly small amount. Bitcoin consumes about 0.1% of the energy produced in the world. In terawatts-hour, it consumes less than the gaming industry, than gold mining and 8x less than the entire banking system.

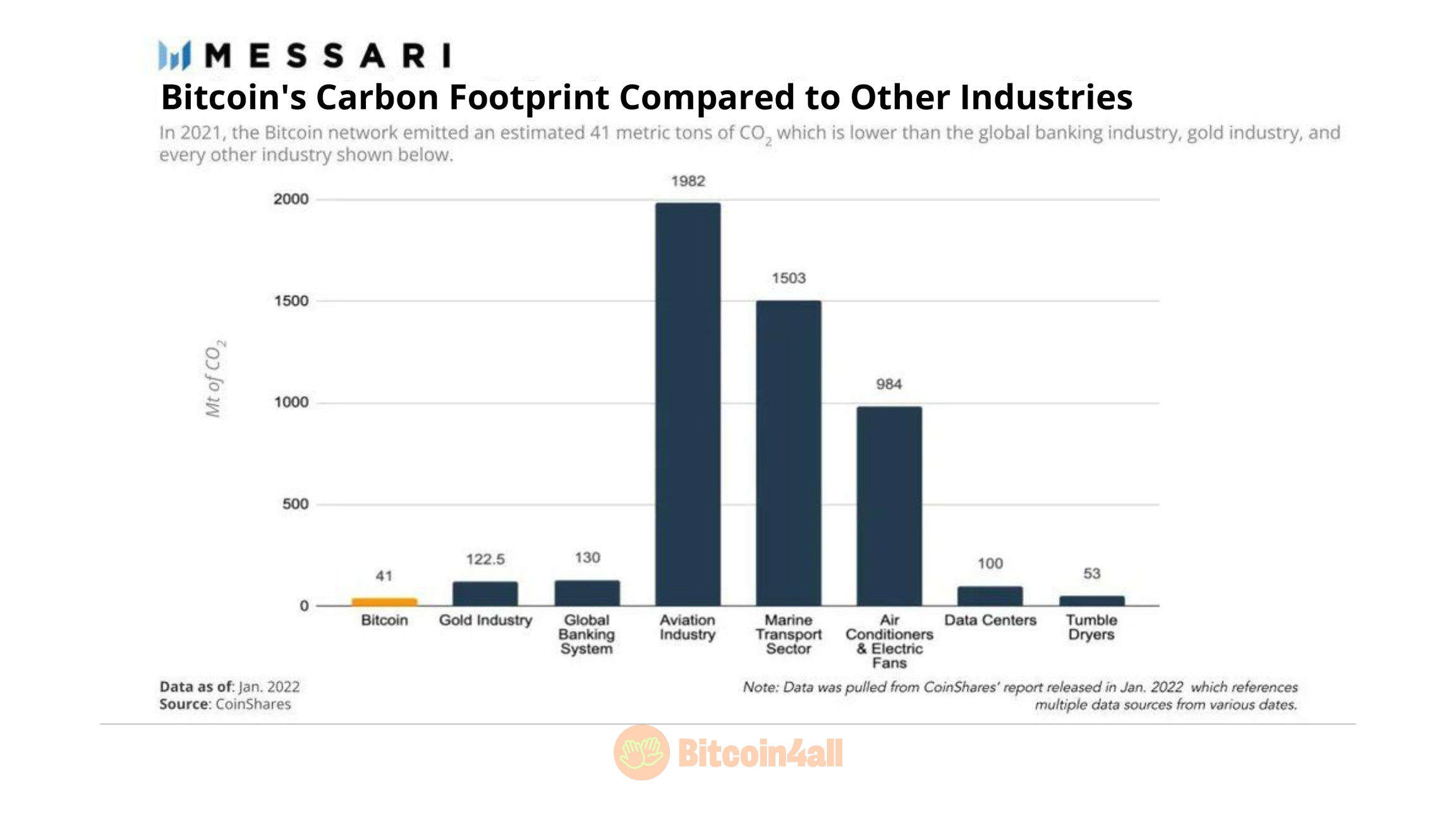

If you compare the carbon footprint of these industries, they are also much larger than the emissions of the Bitcoin network.

Bitcoin has a carbon footprint of 41 metric tons. That's 3x less than gold mining, the banking system, data centers and less than the global clothes dryers' carbon footprint. The center columns are the aviation sector, marine transport and global air conditioning.

Bitcoin is responsible for only 0.07% of all CO2 emissions on the planet and, unlike several stagnating industries, Bitcoin tends to reduce its carbon footprint over time. This will happen as new, more efficient devices are developed, as well as more efficient mining. Just like how refrigerators started to be replaced by models that use less electricity.

Compared to other countries or industries, Bitcoin uses far more renewable energy sources, as you can see in the green bars, than more sustainable countries like Germany, the United States, Canada and Europe. Bitcoin has at least 56% of its network made up of renewable sources, compared to 49% in Europe, 48% in Germany and 30% in the United States.

Remember the mining lesson, where we saw that Bitcoin forces miners to be efficient? These miners naturally settle in places with abundant and cheap energy, usually renewable sources, and even in regions where energy is wasted.

This image shows how Bitcoin uses only 0.1% of global energy and consumes 0.4% of the energy that would otherwise be wasted. In other words, much of the energy that Bitcoin consumes is precisely the energy that would be wasted by other industries.

What happens is that miners naturally end up settling in places with surplus energy production, energy that would otherwise be thrown away. In general, renewable sources such as hydro and geothermal are the most chosen locations, such as Iceland, Siberia, Canada, Russia and the United States. These are places with a lot of energy and little population or industry present to consume the surplus energy. These sites generally have no way of storing all the energy produced.

That's where Bitcoin mining comes in. It's a plug and play industry, easy to install in any region of the planet and repurposing energy that was previously being thrown away with an useful destination.

This is where the theory of Bitcoin as a global battery that converts wasted energy into the strongest money in existence. It's money that can be easily stored and used to buy more energy in the future, if the need arise.

That's why energy producers have approached Bitcoin, since it offers a possibility that didn't exist before: monetizing idle energy.

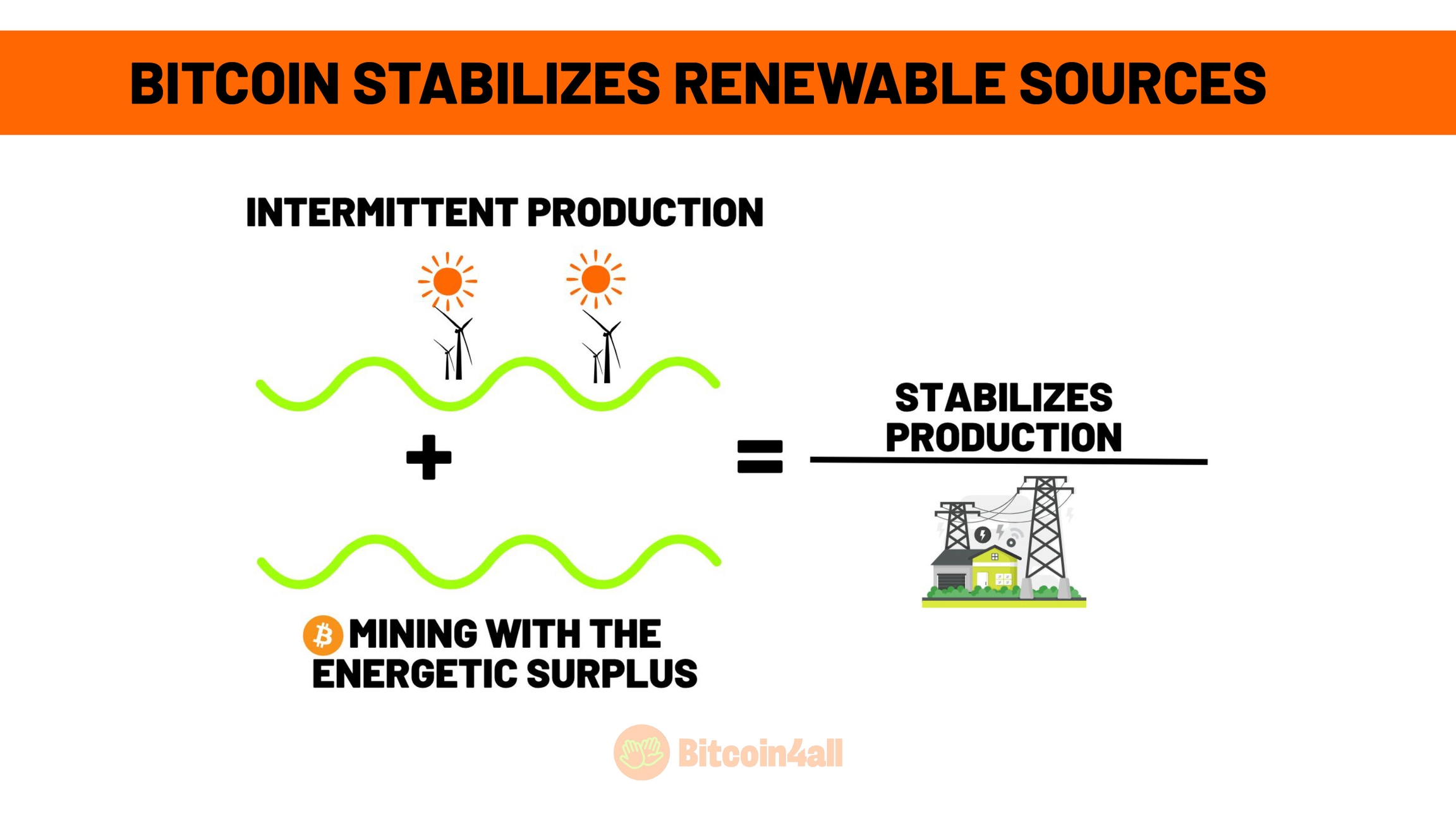

Intermittent sources such as wind or solar energy have periods of high sunshine or wind that produce a large energy surplus. But there are also periods when there is no wind or sunlight at all and production is reduced. At such times, these sources might even have to buy energy from elsewhere in order to feed the local grid.

So for the energy industry, Bitcoin is a magnificent tool because it stabilizes the grid and gives more predictability. Whenever excess energy is produced, these sources can turn on the miners and receive Bitcoin. During periods of low production, they can turn off the miners and use the accumulated Bitcoin to buy more energy from other sources, if necessary.

This means that Bitcoin stimulates renewable sources in a way that wasn't possible before, preventing energy waste and giving more predictability to the entire renewables industry.

In addition to stimulating renewable sources, Bitcoin is also turning carbon negative by collaborating with refineries and landfills to prevent polluting gases from being released into the atmosphere.

Methane gas is 86x more polluting than CO2 and is a byproduct of oil extraction and the putrefaction of waste in landfills. That's why these places set fire to the gas outlet before releasing it into the atmosphere, as you can see in this photo. It's better to throw CO2 into the air than methane, which is absurdly more polluting. They also do not find anything useful that can be done with this CO2. Accumulating it leads to a risk of explosion.

That's why refineries and landfills are starting to mine Bitcoin. In the end they have always wasted energy, methane, and realized that by plugging into Bitcoin mining they could monetize the wasted gas and also AVOID methane being dumped into the atmosphere.

As a container full of ASICs is super easy to install, this mechanism is starting to spread around the world. In this way, Bitcoin prevents both methane and CO2 from being dumped into the environment and also converts these gases into energy to mine a scarce currency that increases in value over time. Until then, no industry had any real use for these gases. Bitcoin, while monetizing and preventing waste, also prevents these polluting gases from entering the atmosphere.

There's even a researcher called Daniel Batten, who is a former Greenpeace researcher and also a bitcoiner, who has already shown how Bitcoin is the network with the most potential to contribute to the environment, because it manages to be carbon negative and prevents CO2 from entering the atmosphere. Other networks don't offer this possibility. Ethereum, for example, can even become carbon neutral, but does not contribute to being carbon negative, as displayed in the image.

According to Daniel's research, Bitcoin could use 24% of all landfill methane by 2030 and the garbage industry could end up joining forces with the Bitcoin industry.

Daniel Batten, shows how Bitcoin is the most ESG-friendly industry in the world in other researches. It has grown a lot in terms of sustainability in the last two years and is more sustainable than any other sector, such as banking, industry, agriculture, gold mining, metallurgy and zinc recycling.

This graph shows that even if Bitcoin continues to grow and any metric increases, such as hashrate, users, price and addresses, the network's emissions will be the same at the end of any cycle. Something no other industry has ever managed to do.

In just four years the Bitcoin network has halved the intensity of its CO2 emissions. In such a short period of time, it has the lowest carbon footprint of any major global industry. Such reduction would collapse any other industry.

This is also a consequence of the ban on Bitcoin mining in China in 2021. Most of the sources there use coal, which is very polluting. The simple fact that miners moved to other locations with renewable and abundant sources, such as hydroelectric dams, meant that Bitcoin halved its CO2 emissions, and it did so without ever crashing: the network continued to function normally.

So much so that this graph shows that Bitcoin's main source of energy today is hydroelectric. As Bitcoin mining is not anchored in the global grid, which uses coal 36.7% of the time, it is also the only major industry in which fossil fuels are not the main source of energy. This is a slap in the face to anyone who says that Bitcoin is harmful to the environment.

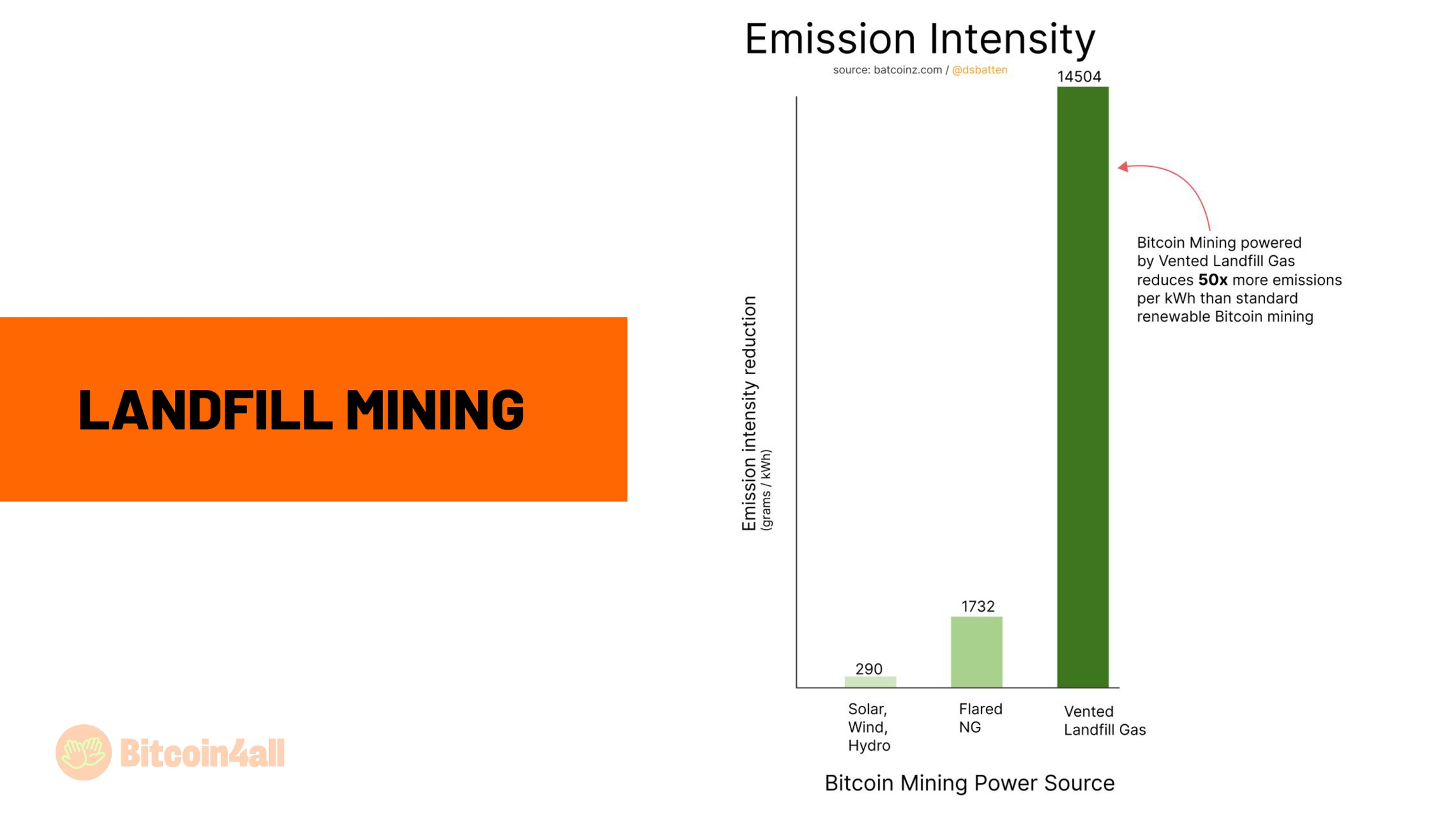

Even Bitcoin in landfills reduces greenhouse gas emissions 50x more than any other form of Bitcoin mining, such as mining with wind, solar, hydro or flared gas from refineries.

This is further proof that the whole idea that Bitcoin uses up a lot of energy and that destroys the planet is either ignorance or a lie from those who are on the side of the banks and the banks themselves in order to scare people away from Bitcoin. Either that or those who see no value in Bitcoin and think that it's all bad without even stopping to analyze reality. Just nonesense to make Bitcoin a scapegoat.

The World Economic Forum itself posted in 2017 that Bitcoin would consume all the world's energy by 2020, a fact that has, of course, not happened. In 2017 they started filling the newspapers with this FUD. It was a big lie that just shows how terrified the owners of the fiat system are of Bitcoin, since it takes the money printer out of their hands.

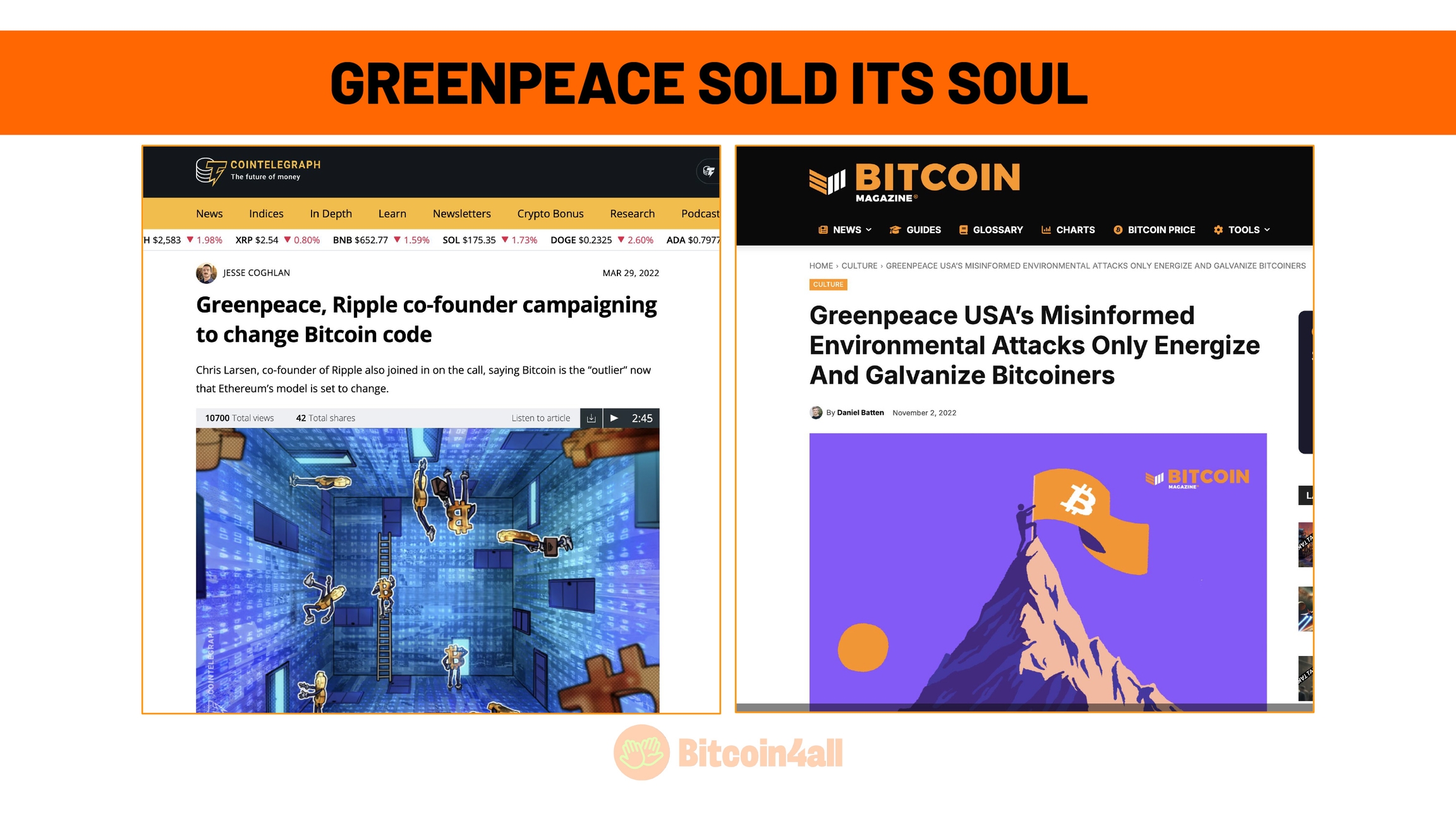

In addition to banks, governments and other protocols, even Greenpeace has started a campaign demonizing Bitcoin, spreading the word that it is bad for the planet and that the code needs to be changed. In 2023 Greenpeace launched the "Change the code" campaign, a manifesto for Bitcoin to abandon the proof of work model. They demonized Bitcoin in various ways. The leader of the campaign appeared at a Solana conference attacking Bitcoin, pushing the idea that Bitcoin had to change its code and be proof of stake like Ethereum.

The curious thing is that Greenpeace itself accepted donations in Bitcoin. What could have made them change their minds and start attacking it?

That's right. Money. Greenpeace received 5 million dollars from executives at Ripple, the company that created the XRP cryptocurrency, to defame Bitcoin and try to force changes through social pressure and lies.

That's the most bizarre concept ever. Greenpeace has abandoned its purpose and scruples for money. It attacked precisely the protocol that could help the organization to reduce emissions and be more environmentally friendly. Surreal! Just take a look at an excerpt from the campaign video:

!(Greenpeace video)[https://www.youtube.com/watch?v=u0mQ7CxyICw]

Greenpeace paid an artist called Von Wrong to make a skull with laser eyes to show how Bitcoin creates climate damage. They wanted to make something like a Bitcoin horror movie.

But in the end, all the attacks end up strengthening Bitcoin even more. Bitcoiners loved the laser-eyed skull. It became a meme and a symbol of how bitcoin is, indeed, bad and deadly, but for central banks and fiat currencies and not for the planet.

Bitcoiners loved the metal feel of the artwork. They appropriated the narrative and started making memes like this one, taking the photo of the Greenpeace car, which was campaigning against Bitcoin, and changing the phrase to "Buy Bitcoin". Very clever. This meme a went viral.

With all the fuss, several bitcoiners contacted Von Wrong, the artist who made the skull. They showed him graphics just like this lesson's. A few days later, the artist posted about how he didn't know all that about Bitcoin, that the skull was a big mistake and that Bitcoin is indeed a positive force for the environment. The burden of lies ended up with Greenpeace once again.

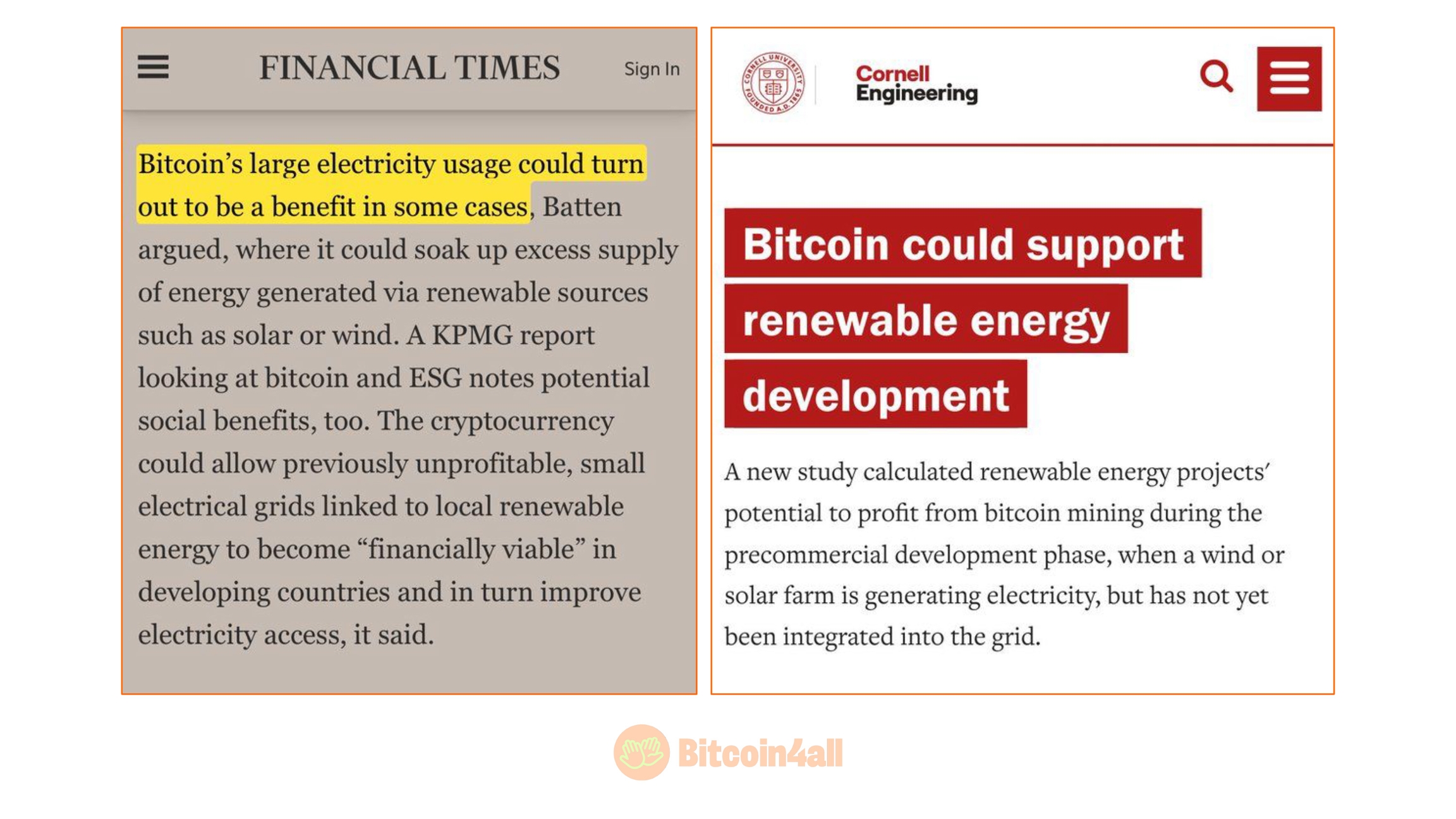

This all happened in March 2023, but now it seems that the narratives are changing. New studies and revisions of previous studies are emerging, providing more real evidence instead of crypto-fiat funded attacks. This article in the Financial Times puts it this way:

"Bitcoin's large electricity consumption could end up being a benefit... it could absorb the excess supply of energy generated through renewable sources such as solar and wind".

This other article says "...Bitcoin can support the development of sustainable energy". The newspapers are finally starting to publish these studies and revise old articles.

What's worse, at the end of 2024 it came to light that Greenpeace's "Change the code" campaign was shut down because it had run out of funds. At last, the great irony! Bitcoin once again bankrupts critics

Well, just showing the following image could have been enough, but perhaps it wouldn't have given the dimension of the data and of how much Bitcoin actually helps us to advance on energy, environmental and civilizational issues.

On the left we have a photo of a gold mine. Look how destructive it is. Not to mention the contamination by heavy metals and the landslides that occur. On the right is a Bitcoin mining farm living in the middle of nature. If it ever leaves the premises, it won't leave a hole and won't have any kind of local environmental impact, on the contrary.

Bitcoin mining is being integrated with local industries such as plant and fish production using heat, a byproduct of mining, to be even more efficient.

We hope this lesson has made it clear to you that Bitcoin doesn't destroy the environment and that it's actually fiat structures that do so, mostly.

I hope you've understood the main pieces of FUD spread about Bitcoin. It's important to remember that new FUD pops up from time to time, so keep an eye out and always do your own research so you don't fall prey to the grapevine effect.

Now that you know what Bitcoin is, how it works, ways to own it and the main lies about it. In the next lesson you'll learn why storing your bitcoin is important. Until then.

Additional Resources

📢 Share this lesson!

Twitter LinkedIn WhatsApp Telegram

📈 Your Course Progress

Class 8 de 10 (80% completo)

Last updated