Class 2 - The problem with fiat money

2 Class 2 - The problem with fiat money

🎥 Class Video

👉 Click here to watch on YouTube

Full Script

Class 2 - The problem with fiat money

Money created by governments -- fiat money -- has a problem:

It is a big ice cube. It constantly melts in value. Maybe you haven't perceived this yet, but this "melting" has an effect that you probably already noticed: everything gets more expensive over time.

Every year, grocery shopping gets more and more expensive. The cost of filling up the trolley with basic products is getting higher and higher and wages are not keeping up with this general price increase. And why is that? That's because your money is constantly weakening and losing its value.

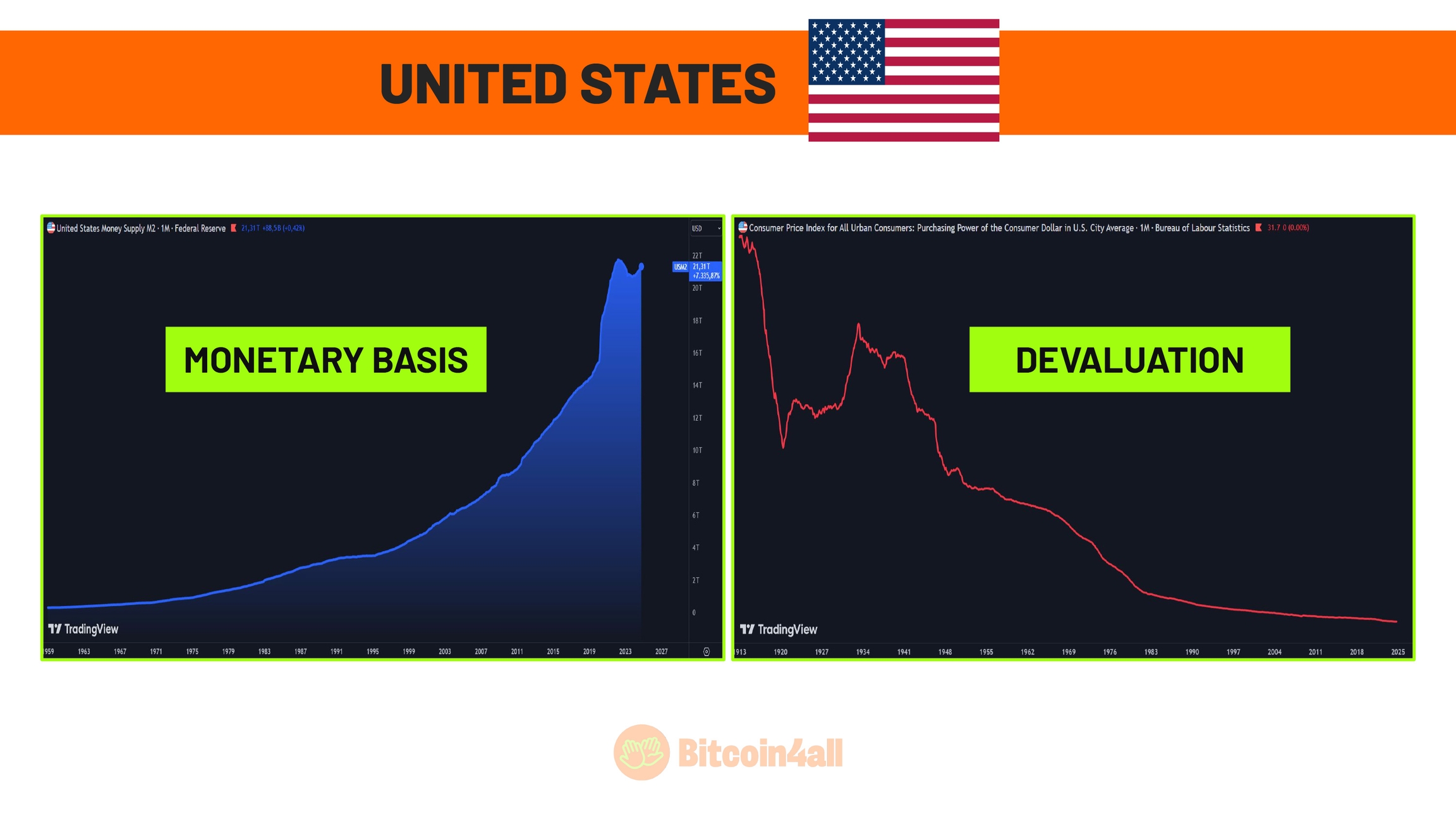

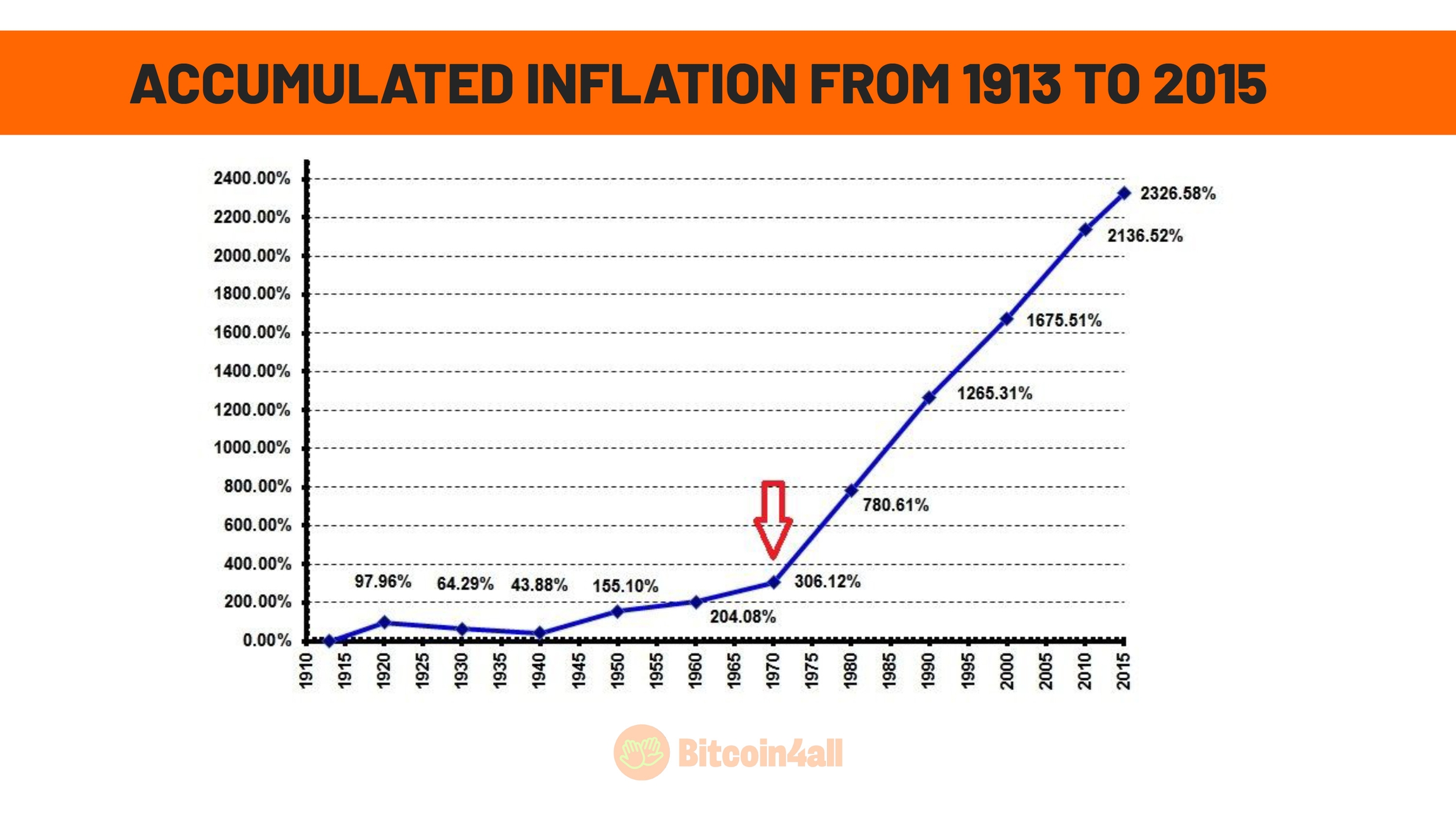

The dollar has lost 97% of its value since the Federal Reserve, the central bank of the United States, was created in 1913. The purchasing power of 100 dollars today is equivalent to 3 dollars 120 years ago. This means that today you need to have 100 dollars to buy the same things you could buy with 3 dollars when the US currency was created. Impressive, right?

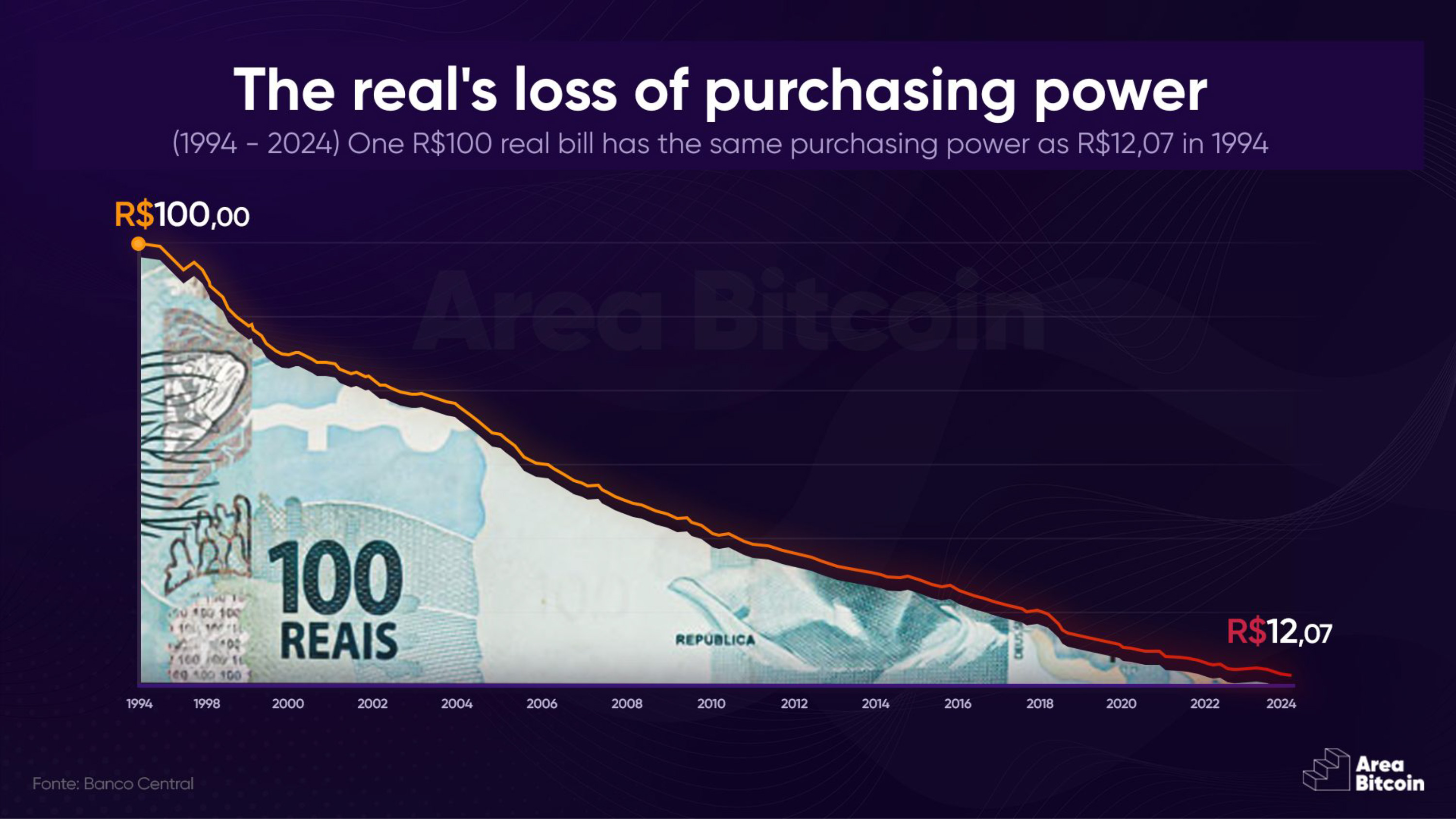

For an even faster example of this loss of value, we can consider the real, the Brazilian currency. It has lost 87% of its purchasing power since it was created in 1994, after decades of suffering from hyperinflation, confiscation of savings and recurrent economic crises. Today, almost 30 years later, the purchasing power of 100 reais has the same purchasing power as 12 reais in 1994. It melted a lot and in less time than the dollar!

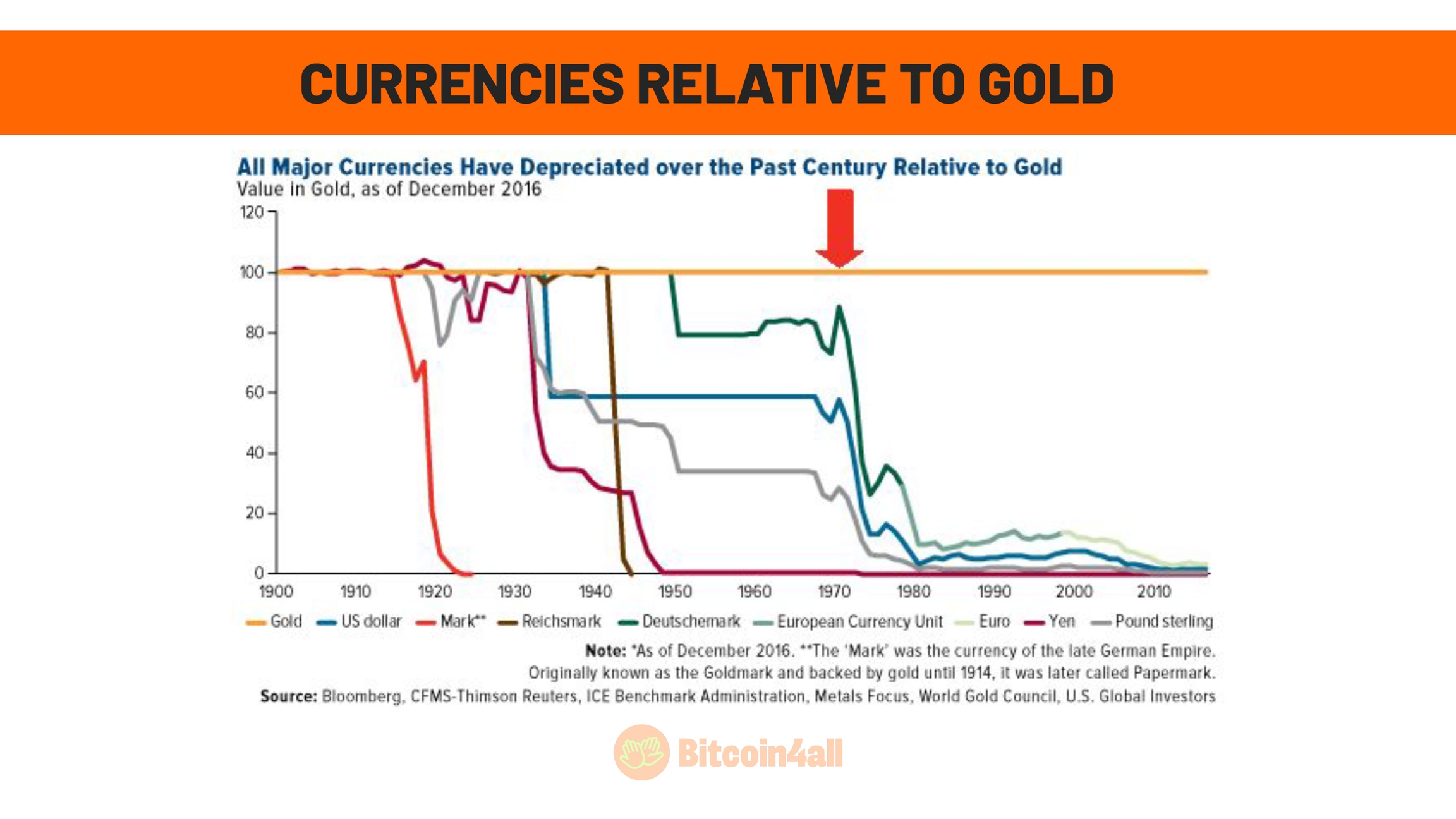

But this doesn't just happen with the dollar or the real. All currencies go through this same process and lose purchasing power over the years.

According to World Bank data, all global currencies have lost value since the 2000s, that is, over the last 25 years. The Japanese yen lost 50% in value, the euro lost 73%, the pound sterling 75%, the US dollar 78%, the Australian dollar 85%, the rupee 99%, the Chinese yuan 99%, and the Nigerian naira also lost 99%.

ALL government currencies have melted in value in just 25 years. This destroys generations who are working every day of their lives to receive money that holds no value. It's an ice cube.

That's why you notice everything getting more and more expensive and going up in price: deep down, it's your money that's losing value. Prices seem to be going up, but it's the money that's going downhill.

The truth is that price rises are just a symptom, and not the cause, of inflation.

The most common and accepted concept is that inflation is the continuous and generalized increase in the price index. The increase in the price index means that products are simply going up in price in the supermarket. But this rise is only a symptom of the weakening and devaluation of the currency.

This means that money is losing value compared to products and services. The same situation has already happened several times in history and in several countries. Although inflation is something everyone knows about and feels deep down in their pockets, few people really understand how and why it happens.

And as Austrian economist Milton Friedman has said since the 1970s, only central banks can create widespread inflation because only they can print money. Only central banks can manipulate the existing money supply.

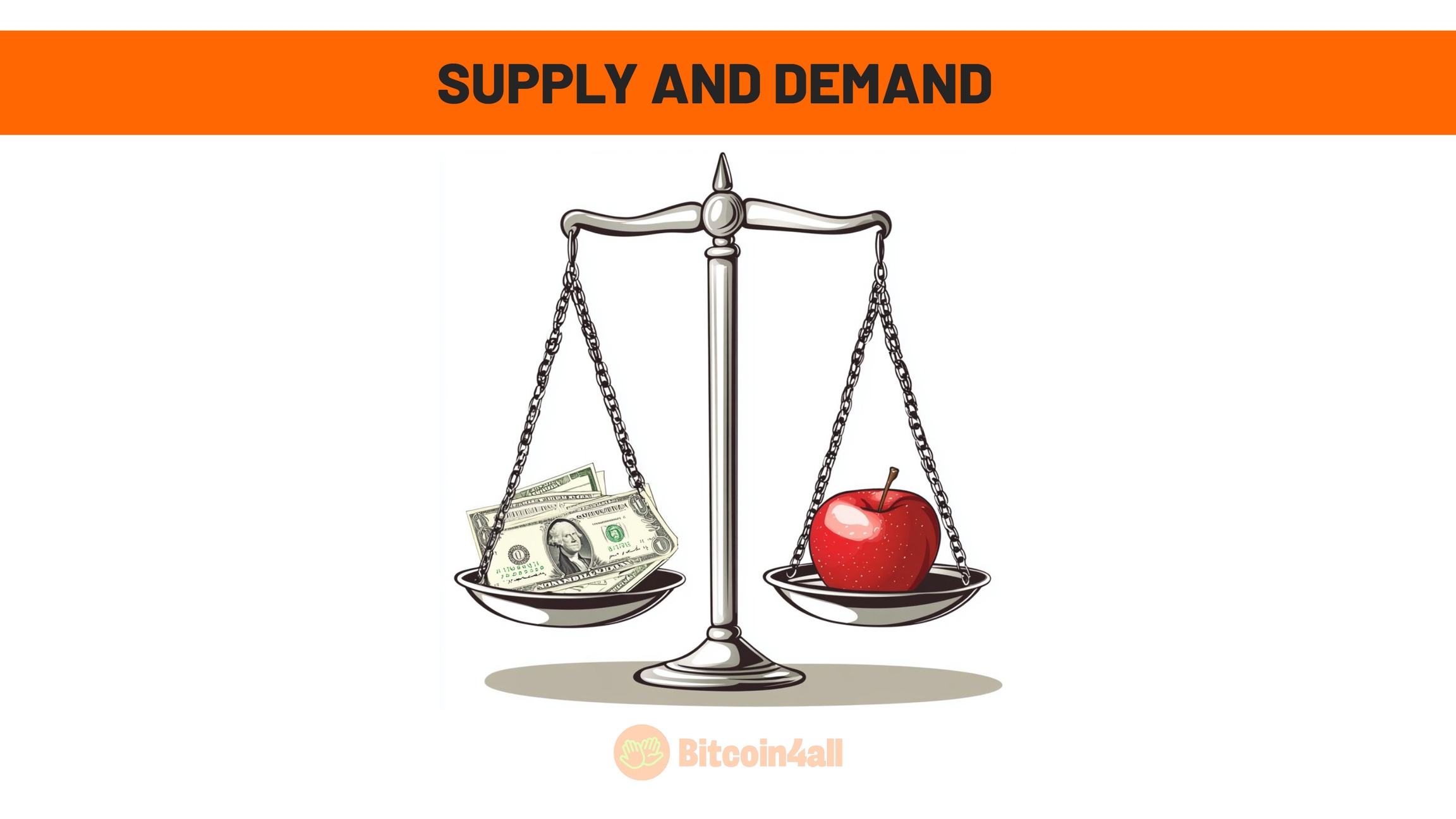

Prices in the economy are determined by the supply and demand of all things, even money. After all, money helps us to correlate value between different things. It helps us understand whether something is expensive or cheap.

This means that the price of an apple, for example, depends on two factors: the quantity of apples available and the demand for apples. If a pound of apples costs 3 dollars and many people decide to make recipes with apples, here's what happens: demand increases. It's likely that apple prices will rise because demand has increased. On the other hand, if a pound of apples costs 3 dollars and the harvest was very good, to the point where there are a lot of apples in stock and the sellers need to sell them all before they spoil... what happens? Yes, the price drops.

That's why supply and demand is what determines the price of anything in the economy. And money is the tool we use to measure value.

The same thing happens with money. If more money is created in relation to how much people produce, money will lose value in relation to products and services, after its supply has increased. On the other hand, if the creation of money stops and the demand for it remains stable, its value tends to increase.

Money created by governments is known as fiat money, because it is money made by decree. The word "Fiat" comes from Latin and means "let it be done". In other words, it's money whose value is determined by third parties, which force people to use it, and can be created out of thin air by printing more notes or simply typing it into the central bank's computer.

When central banks of governments print money or create digital money at the push of a button, they are increasing the money supply. They are expanding the monetary base. And it's crystal clear: as central banks print more money, they destroy the purchasing power of the local currency. It just devalues. This happens in every single country.

In Brazil, the central bank has expanded the monetary base by more than 5,000 percent since the real was created; since then, the Brazilian currency has lost 99% of its value against the dollar.

The same thing happened in Venezuela recently, from 2012 to 2018. As the central bank created more money, the value degraded.

In Turkey, it's the same picture: printing money, in the image on the left, and the consequent devaluation of the currency in the same period, in the image on the right.

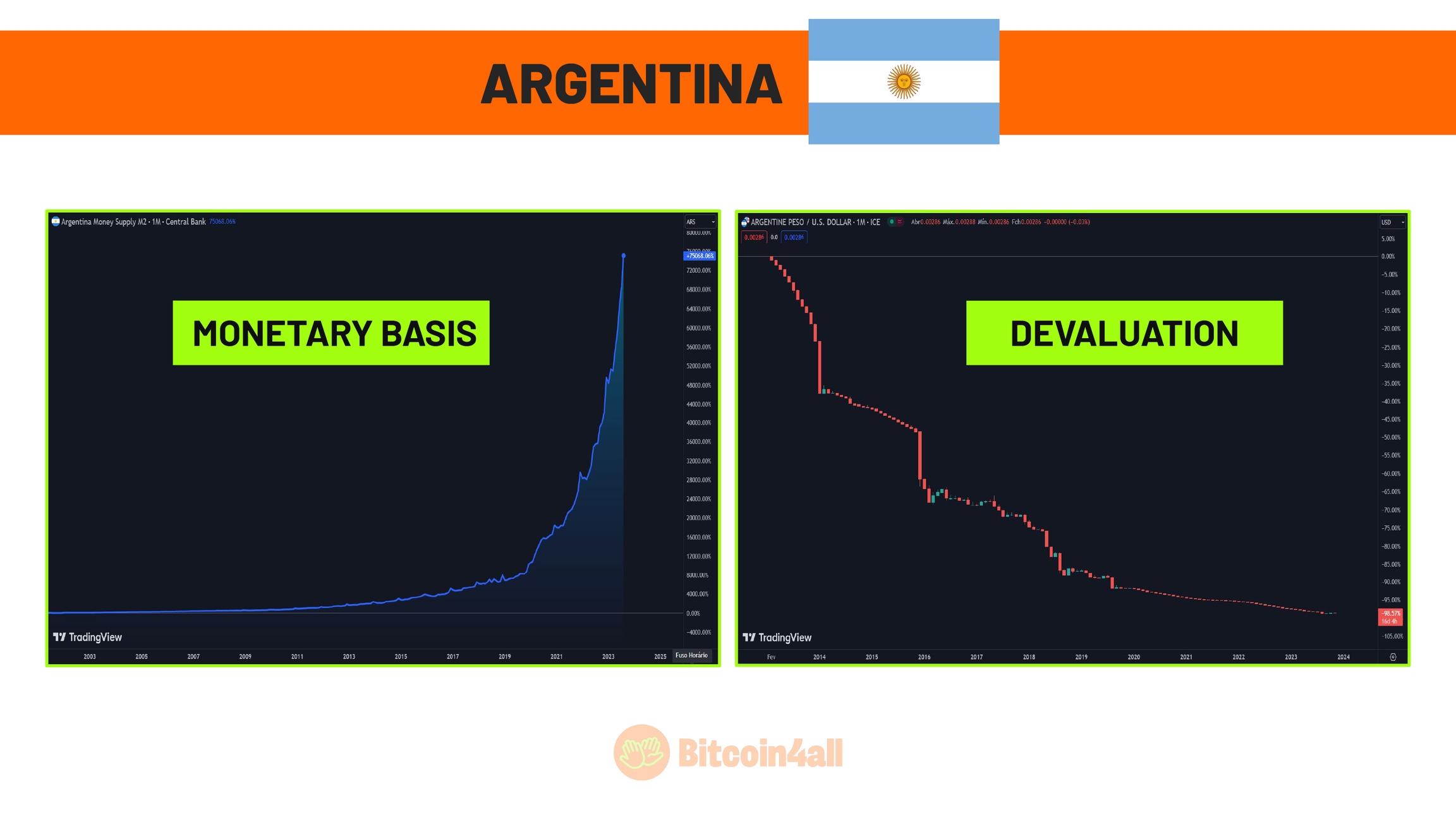

Not to mention Argentina. Same thing. The graphs and data speak for themselves. Central banks print money and the currency collapses in value. The more they print, the more the money melts.

Even the dollar, the strongest currency with the greatest global demand, has constantly increased its supply and lost value as well. Notice that, as value is drained, money begins to fail in its role as money. And when money fails, it's the people who suffer the most.

Brazil has a long history of situations in which money has completely lost its function. Throughout history, several Brazilians currencies became extinct because of hyperinflation -- a scenario in which prices skyrocket because the government prints money uncontrollably. The currency loses so much value that people can no longer trust it. When hyperinflation takes place, desperate attempts are made to try to "contain" the crisis. Governments resort to measures such as imposing fixed prices for products and services or forcing the population to "price control". But guess what? These measures don't work. On the contrary, they only increase the chaos and indignation.

With prices rising at a gallop every day, merchants need to constantly readjust their tables. This instability breaks down confidence in money as a tool for measuring or storing value. People are beginning to realize that the money in their wallet or bank is worth less every day. So what do they do? They rush to spend it. Instead of saving money, people start buying anything that preserves value -- food, products, durable goods.

And that's when the chaos intensifies. Everyone rushes to stock up on food and basic products because they know that everything will be more expensive tomorrow. The shelves are starting to empty. There is no longer a demand for money; people's focus is on tangible goods that preserve value. Money as we know becomes an "ice cube" that quickly melts in the hands of those who hold it.

This cycle leads to widespread shortages: not because the products have disappeared, but because nobody trusts the money anymore. People hoard what they can, businesses can't replenish stocks in time, and the economy becomes a desperate race for survival.

This extreme scenario shows us the importance of rethinking what money is and how it should work.

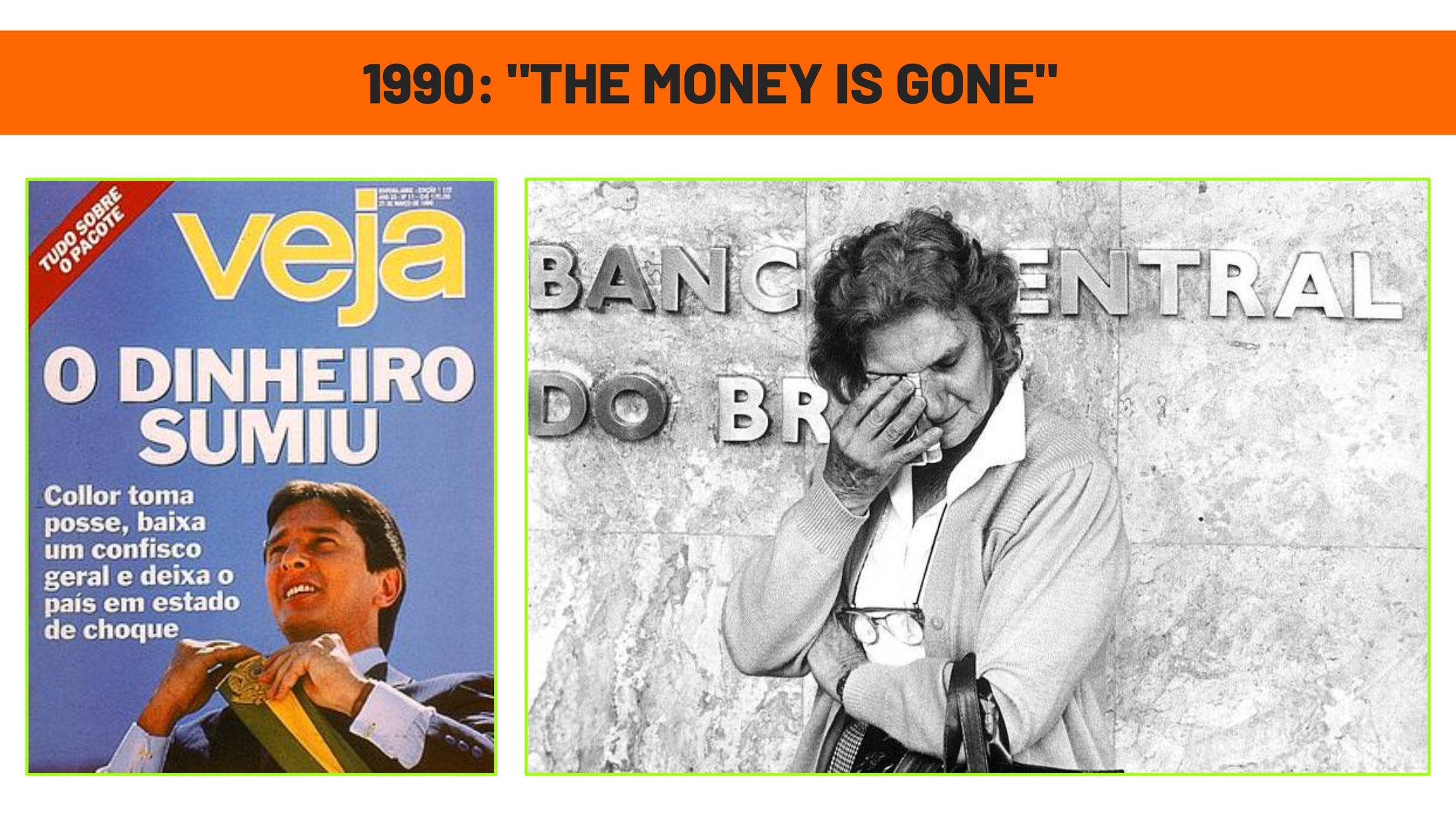

When inflation gets out of hand, governments often resort to desperate -- and often absurd -- measures that end up directly harming the population. One of the most striking examples in Brazil happened in 1990, when the government confiscated Brazilians' savings accounts. Yes, it sounds like something out of a movie, but it really happened.

At the time, in order to "fight inflation", the president decreed an overnight national holiday. Suddenly, people could no longer withdraw their own money from banks. And do you know what the justification was? To prevent inflation from continuing to rise. Ironically, though, this inflation was the result of decades of mismanagement, uncontrolled spending and unbridled money printing by the government itself. The result was a real crime against the population, whose trust and financial security were brutally stolen.

Stories like this are not exclusive to Brazil. In several countries, governments use their control over the financial system to confiscate wealth, either through arbitrary actions such as direct confiscation, or through the unbridled issuance of money, which gradually and silently erodes the value of economies.

What these cases show us is simple: if your money is in the bank or depends on a central bank, it's not really yours. You are at the mercy of the decisions of others -- decisions that can change overnight. Today it could be a law that freezes your funds; tomorrow it could be inflation that silently drains your purchasing power.

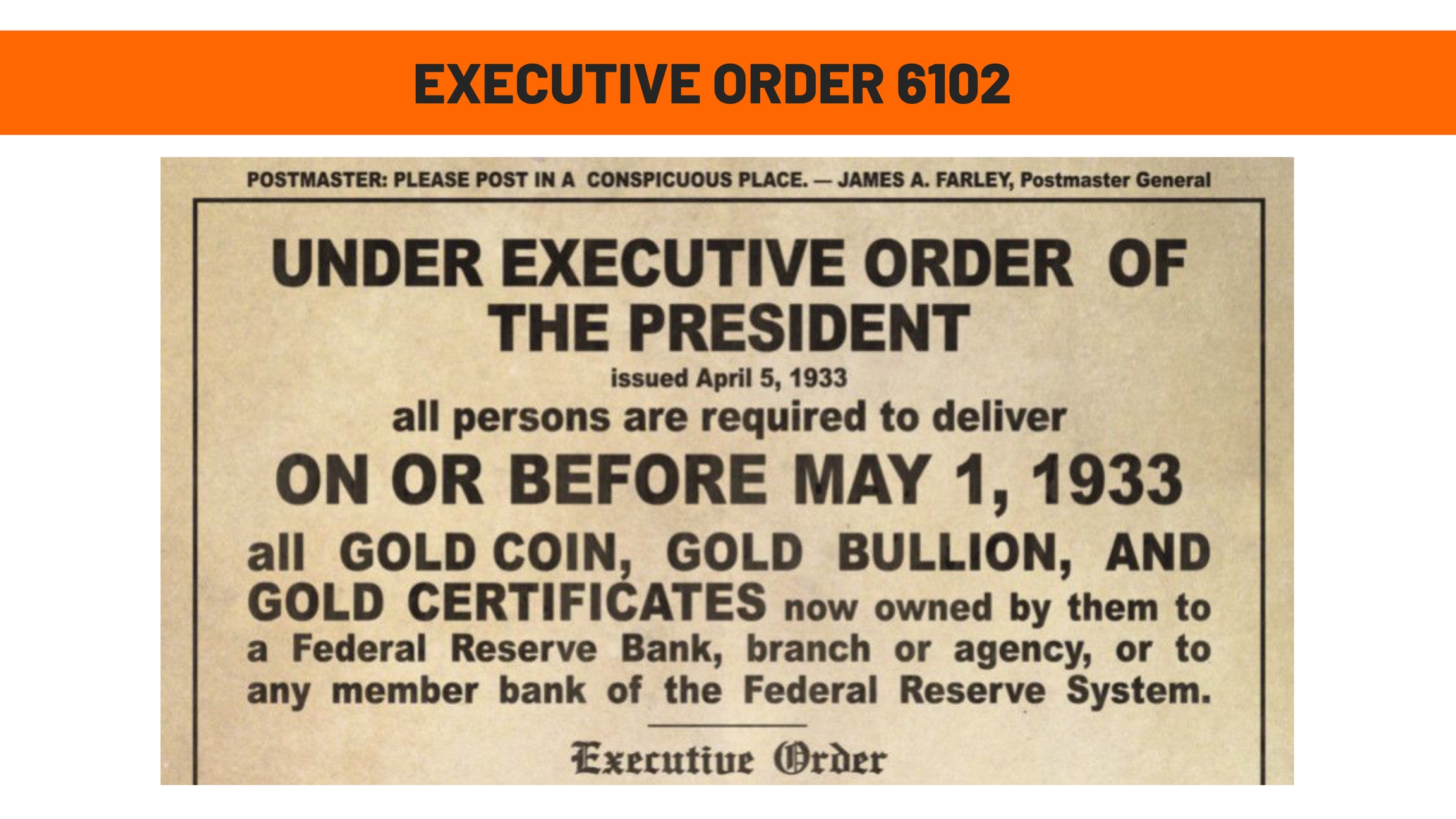

But it's not just in Brazil and developing countries that governments confiscate from the population at the drop of a hat -- the same thing has happened in the United States too!

In 1933, the US government confiscated the population's gold in a kind of "regulated theft". Through Executive Order 6102, it was decreed that all citizens had to hand over their gold to the Federal Reserve. This measure obliged people to hand over their wealth to the government, under penalty of legal sanctions. That was a massive confiscation.

If you didn't hand over the gold, you'd face a fine of 10,000 dollars, 10 years in prison, or even both! This is the reality of how governments, at different times in history and in different countries, have abused the power they have, either by printing money uncontrollably, thinking that no one would notice, or by confiscating it directly. The result is always the same: the population ends up paying the price and losing assets.

The point is: it wasn't always like this. Fiat money as we know it today is actually the exception throughout history. It is the greatest experiment ever carried out by governments.

In the past, gold was widely used as money throughout entire civilizations. Gold was a form of wealth that people could carry around with them, without depending on intermediaries. It didn't need banks to be stored or governments to validate its value. The value of gold was validated organically by the people themselves. Gold was literally "bearer" money -- if you had gold in your hands, it was yours, without depending on anyone else.

Today the financial system is very different, and what we consider "normal" -- money issued by governments and stored in banks -- is actually quite an anomaly in the history of money. For thousands of years, gold was the basis of trade and wealth, while the fiat money we use today, without any real backing, is a recent invention, created in the last few decades.

Gold allows you to keep it, bury it or leave it forgotten for years: once you get it back, it will still have value. It's like in pirate movies, where a chest full of gold coins is often buried. Whoever finds this treasure, even centuries later, will be able to use it, because gold retains value, no matter how much time passes.

This durability is one of the reasons why gold has been so widely used as money throughout human history. It doesn't rely on governments or banks to have value. It won't rust when buried in the ground. That's why gold has been used as money for millennia.

Gold preserved value because it had very specific monetary properties that placed it in the position of money organically chosen by people as the best way to store value over time, for the future. Gold is durable, divisible, fungible, portable, verifiable, relatively scarce and globally accepted as a store of value. In the next lesson we'll break down all these properties and compare each of them with gold, fiat and Bitcoin.

These properties can explain why gold has been chosen as money throughout much of history and is still seen as a reliable store of value today.

If you compare the performance of government-issued currencies with gold over time, you'll see that they all lose value against it. In this graph, the yellow line represents the value of gold, while other colored lines show the main global currencies, such as the dollar (in blue), the German mark merging with the euro (in shades of green), and the pound sterling (in gray). The standard is clear: gold retains its value, while fiat currencies lose it.

But why is that? The answer lies in the nature of gold and how it differs from fiat currencies, those issued by governments. Gold is relatively scarce, and its supply cannot be increased easily or arbitrarily. Before the emergence of Bitcoin, gold was the most difficult commodity to expand the supply of. Extracting gold from the earth is expensive, laborious and limited by natural reserves. This has created a stable and tamper-resistant offer for many years, preserving value over time.

In addition, gold has atomic stability. This means that, even with the advances in science, recreating gold in a laboratory is economically unfeasible, since it's so expensive.

So gold became the most widely used money in history; upon becoming money, it took on 3 functions:

It became a store of value because people knew that it was capable of preserving value even as time goes by. Unlike other goods that could spoil, wear out or lose their usefulness, gold was durable and reliable. Keeping gold meant having something that would be valuable not only in the present, but also in the future, between generations.

In addition, gold stood out as an efficient medium of exchange. Because it was divisible, it could be made into different sizes, from large bars to small coins. This made transactions easier, as people could use gold to buy both simple things, such as food, and high-value items, such as land. The possibility of minting gold into standardized coins also helped to make exchanges more practical, which led it to be accepted as a medium of exchange.

With coinage, it became obvious to price goods and services in quantities of gold. This means that people began to evaluate the value of everything around them in terms of gold. How much is a sack of wheat worth? X gold coins. How much is a horse worth? Some other amount of gold. This standardization brought clarity to trade and helped build more organized and functional economies. The monetary properties of gold created the basis of good money for ancient and modern economies.

But just as stones, shells and salt were used as money in the past and were eventually replaced, gold has also been replaced as the monetary standard. All money can be demonetized if something with better monetary properties comes along. This is part of the natural evolution of money, which follows people's needs and improvements in the characteristics that make something useful as a medium of exchange, store of value and unit of account.

The evolution of money has always been linked to the improvement of these properties. Millennia ago, for example, shells were used as money. They were valuable because they were scarce in certain regions, such as the mountains. But when people began to move and take shells from the coast to these regions, they lost their scarcity and, consequently, their value. The result? The shells no longer functioned as money because they could no longer preserve value.

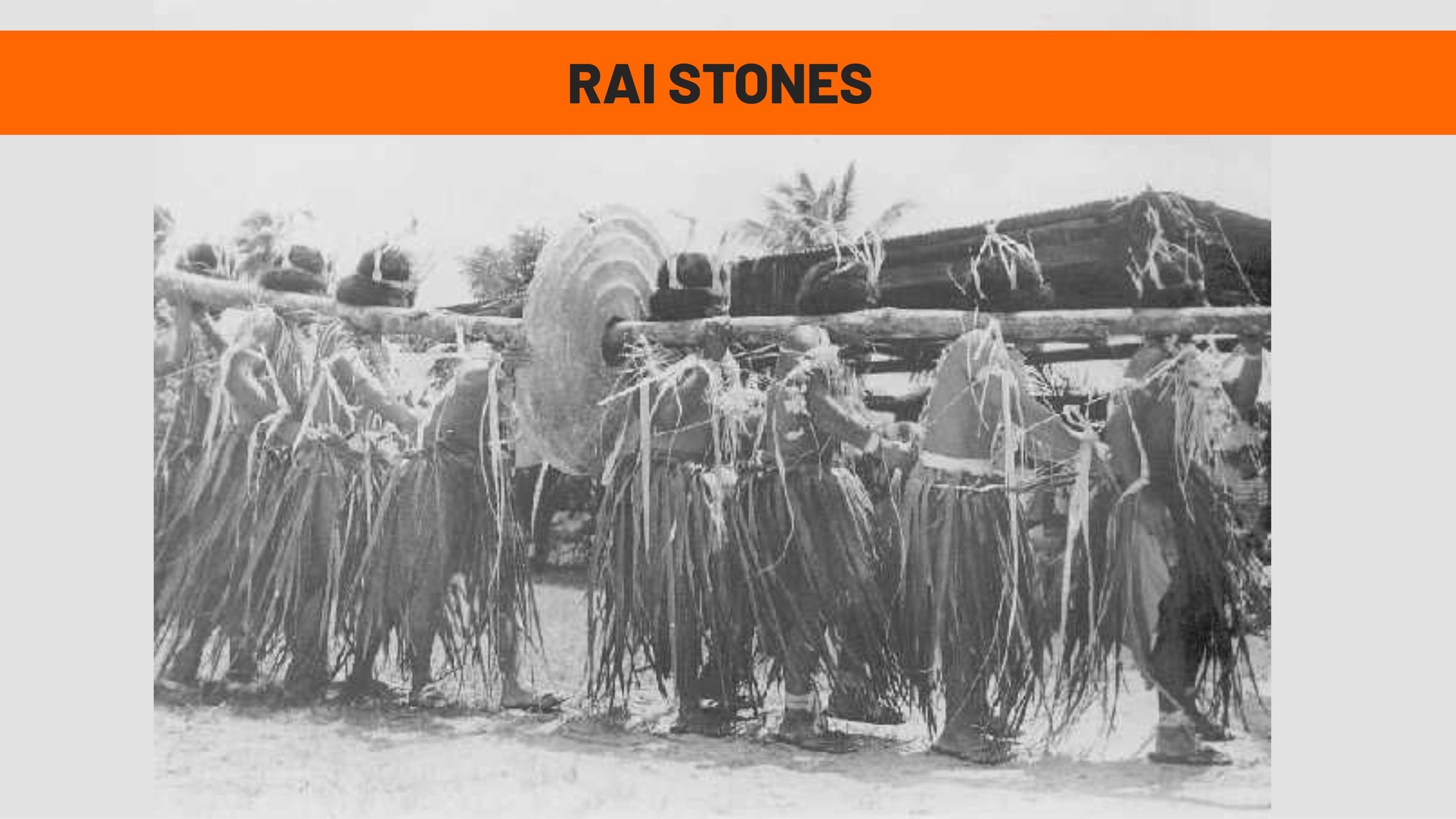

A fascinating story that helps to understand this evolution is that of Rai Stones, which were used as money on the island of Yap in Micronesia until 1871. The Rai Stones were large limestone disks with a hole in the middle, varying in size and shape. They were not only a form of money, but also a status symbol. The families who had the biggest and most beautiful stones were considered the richest on the island.

The limestone needed to make these stones simply did not exist on the island of Yap. For this reason, the stones had to be sourced from neighboring islands, which made their production an extremely laborious and time-consuming process. Moving a Rai Stone required effort, energy and planning, which limited production and thus helped maintain the value of the stones as money. This process, which involved significant work to create and transport the stones, is a precursor to the concept of proof of work, which we will explore later in this course.

For a while, Rai Stones worked well as money. They were difficult to counterfeit, their production was limited and they required effort. All of these are important characteristics for preserving value.

Whenever a giant stone arrived on the island, the whole village knew who owned it because everyone had to work together to carry it. If the stone was used in a trade, the Yapese would only announce who the new owner was. This is a fine example of decentralized money ledger, the difference being that it was analog and not digital.

However, the arrival of an Irish businessman on the island put an end to this monetary standard. The Irishman noticed that the Yapese produced a lot of coconut and wanted to trade it with the locals, but they wouldn't accept foreign money, only Rai Stones. Now look at what the Irishman did. He took explosives and metal tools to the neighboring islands, mined a lot of Rai Stones with way less effort than usual, took them to the island of Yap and bought up all the coconut stocks.

This is how rai stones became abundant on the island and the value of the stones fell until they lost their usefulness as money.

The same happened with gold, which ended up replacing stones, salt and other currencies of the past. Salt, stones, shells and other objects were once money, but not anymore, since they can be produced unlimitedly. The moment a person realizes that all they have to do is pick up the shells from the coast and take them to the desert, they end the object's function as money in the desert, because they end the scarcity.

That's why gold is the main store of value among commodities to this day and why minting coins in gold has been the main form of money for centuries. Because of these properties, even fiat money was backed by gold in the past.

Fiat money replaced gold as the main monetary standard because it succeeded in transferring trust in gold to trust in governments.

This note is from the gold standard period and was convertible into gold: it even had a gold certificate stamp. In other words, the money was issued by the American government, but it was backed by gold, and the banknotes acted as a contract attesting to this. It was the scarcity of gold that brought confidence that governments wouldn't print more money than they had in gold in their vaults, and therefore wouldn't destroy the value of money, which was a contract on a paper note.

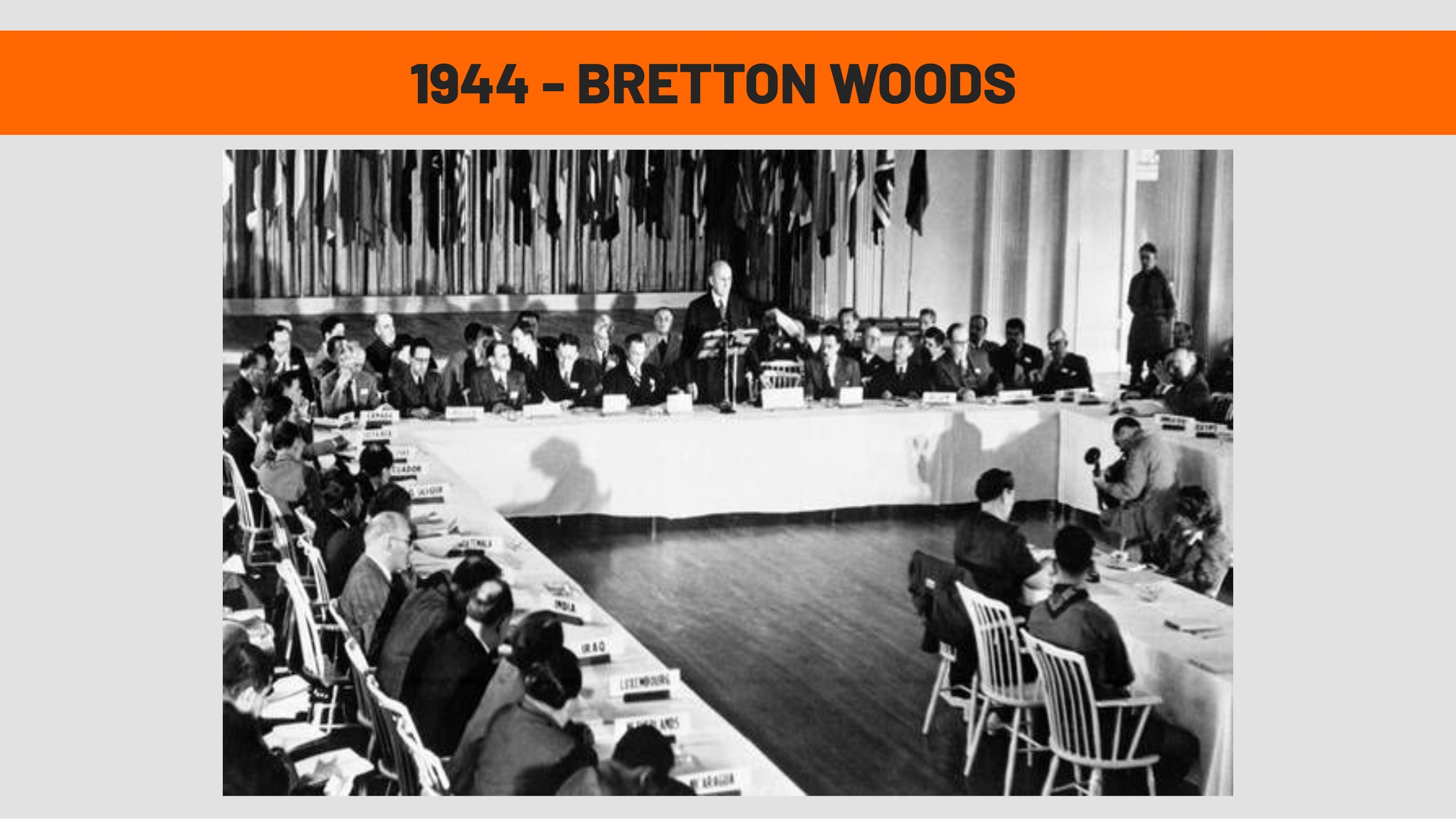

It was because of the United States' large gold reserves that in 1944 the Bretton Woods Agreement took place between countries all over the world, where it was established that the dollar would be the global reserve currency of value and the only one backed by gold. In other words, only the Americans would have gold in their vaults: the other countries would leave their gold with the United States in exchange for dollars. When countries wanted to convert their dollars back into gold, they trusted the Americans to make the exchange.

Countries fixed their exchange rates and currencies against the US dollar; they began to hold US dollars and US bonds in their treasuries. Meanwhile, the United States promised to fix the price of gold at approximately 35 dollars per troy ounce, meaning that every 31 grams of gold would cost 35 dollars. By doing so, all currencies pegged to the dollar would also have a fixed value in gold. It was gold that gave the dollar the confidence to be the global store of value in the last century.

But this trust has been under constant attack throughout history, and with the Americans it was no different. In 1971, President Richard Nixon issued a decree that ended gold backing and the convertibility of the dollar into gold. In other words, no country would be able to convert dollars into gold again. It was a kind of global default.

This movement became known as the Nixon shock and marked the main change in the last 100 years: money ceased to have ballast and became an ice cube. Trust in the atomic properties of gold was replaced by trust in politicians. And as you can imagine... that trust was constantly abused.

Since then, inflation has grown more and more globally because the United States and central banks around the world no longer had any limits on printing money. They no longer had gold limiting how much they could expand the money supply.

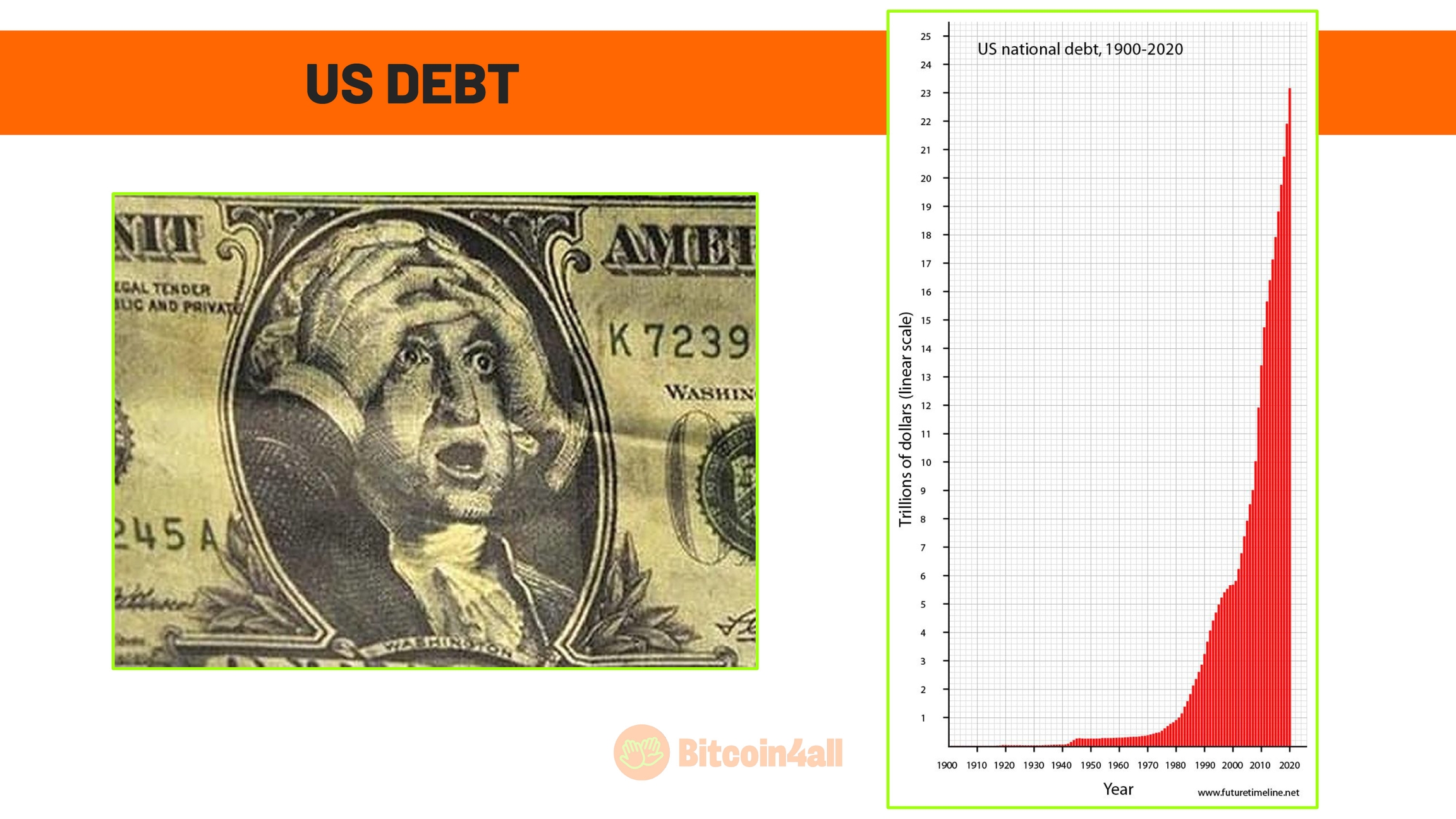

Today, we live in a debt-based global economy. Unlike in the past, when the financial system was backed by gold, it now depends on the ability of governments to issue bonds and print money. This model allowed national debts to grow to historic levels, with the United States leading the way. American debt, for example, continues to break records, reaching an absurd 36 trillion dollars in 2025!

But how does this work? To print money, governments issue debt securities, which are like promises of payment. These bonds are bought by other countries, banks and investors, creating a financial system that relies on the confidence that this debt will be repaid in the future. In practice, gold was replaced by government debt as the basis of the global financial system.

This mechanism allows governments to spend without limits, simply by increasing how much they owe. In the case of the United States, this debt has become the foundation of the global financial system. Confidence in the dollar and the American economy ensures that bonds are widely accepted as "the new gold", or "a risk-free asset" by global markets.

However, this model has a weak point: trust. If at some point the US fails to pay its debt or even delays payments, confidence in the US economy could collapse. This would have devastating effects, since many countries and institutions depend directly on the stability of the dollar and US bonds. A crisis of confidence in this system could contaminate the entire global economy, triggering a new financial crisis.

This scenario makes us reflect on the fragility of a system based on infinite debt and trust in the "power of the money printers". Unlike gold, which was a tangible and scarce asset, today's money and the global financial system are built on something intangible and infinitely expandable: debt.

Governments print money, increase public debt and destroy the purchasing power of their currencies in order to save inefficient banks from bankruptcy.

Here we come to why Satoshi created Bitcoin and the quote he brought up in the genesis block, referring to the second bailout of failed banks through money printing.

Satoshi knew that the money the whole world uses is an ice cube that loses its value because it has lost monetary properties. It relies solely on the promise of governments to pay their debts without destroying the value of the currency... which simply does not happen. The currencies are melting away.

This scenario leads us to an important reflection: what happens when money loses trust as a store of value? As we have seen throughout history, when trust breaks down, money is replaced by better monetary technology.

It is in this context that Bitcoin has emerged as a revolutionary alternative, not only better than fiat money but also better than gold. It doesn't depend on governments, banks or trust in third parties. It recovers the idea of a solid financial system, closer to what gold represented in the past, but even better than gold itself, since it is digital, decentralized, globally verifiable and, above all, mathematically scarce.

Looking at the current scenario, it's easy to see how Bitcoin represents a paradigm shift in the face of an unsustainable and constantly collapsing system.

Bitcoin is better money and a better financial system. In the next lesson, you'll get a deeper understanding of the reasons for this.

Additional Resources

📢 Share this lesson!

Twitter LinkedIn WhatsApp Telegram

📈 Your Course Progress

Class 2 de 10 (20% completo)

Last updated