Class 4 - Decentralization, Blockchain and Game Theory

🎥 Class Video

👉 Click here to watch on YouTube

Full Script

Class 4 - Inside Bitcoin: How Does Bitcoin Work? (decentralization, blockchain and game theory)

In this class you will dive into how Bitcoin works, learning about its characteristics, how the blockchain works, mining, halvings and fundamental technical concepts. Don't worry if you don't understand everything at first. It's normal to need to review and rewatch several times for the learning to consolidate. Over time, the concepts will fit together and make more and more sense.

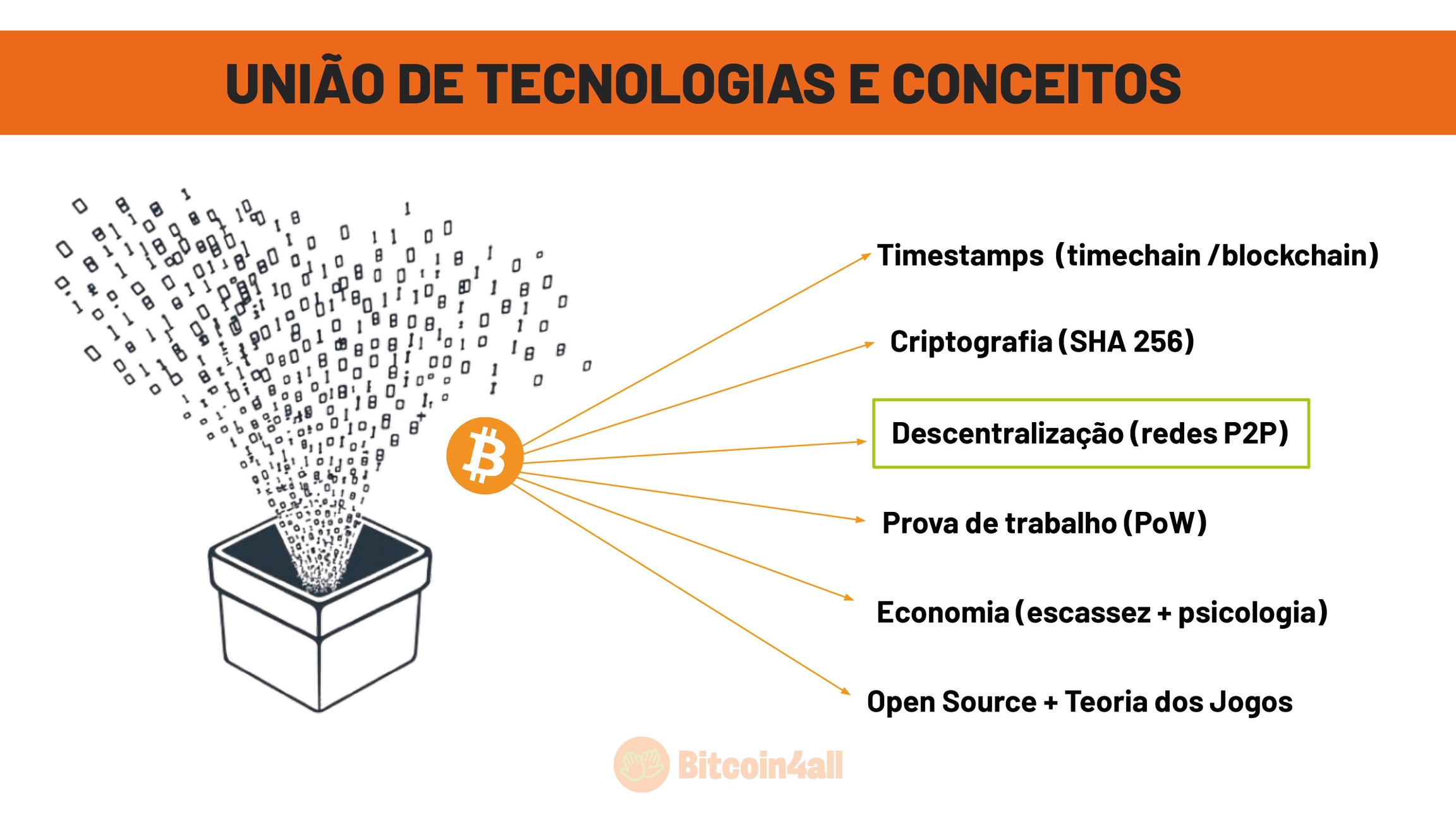

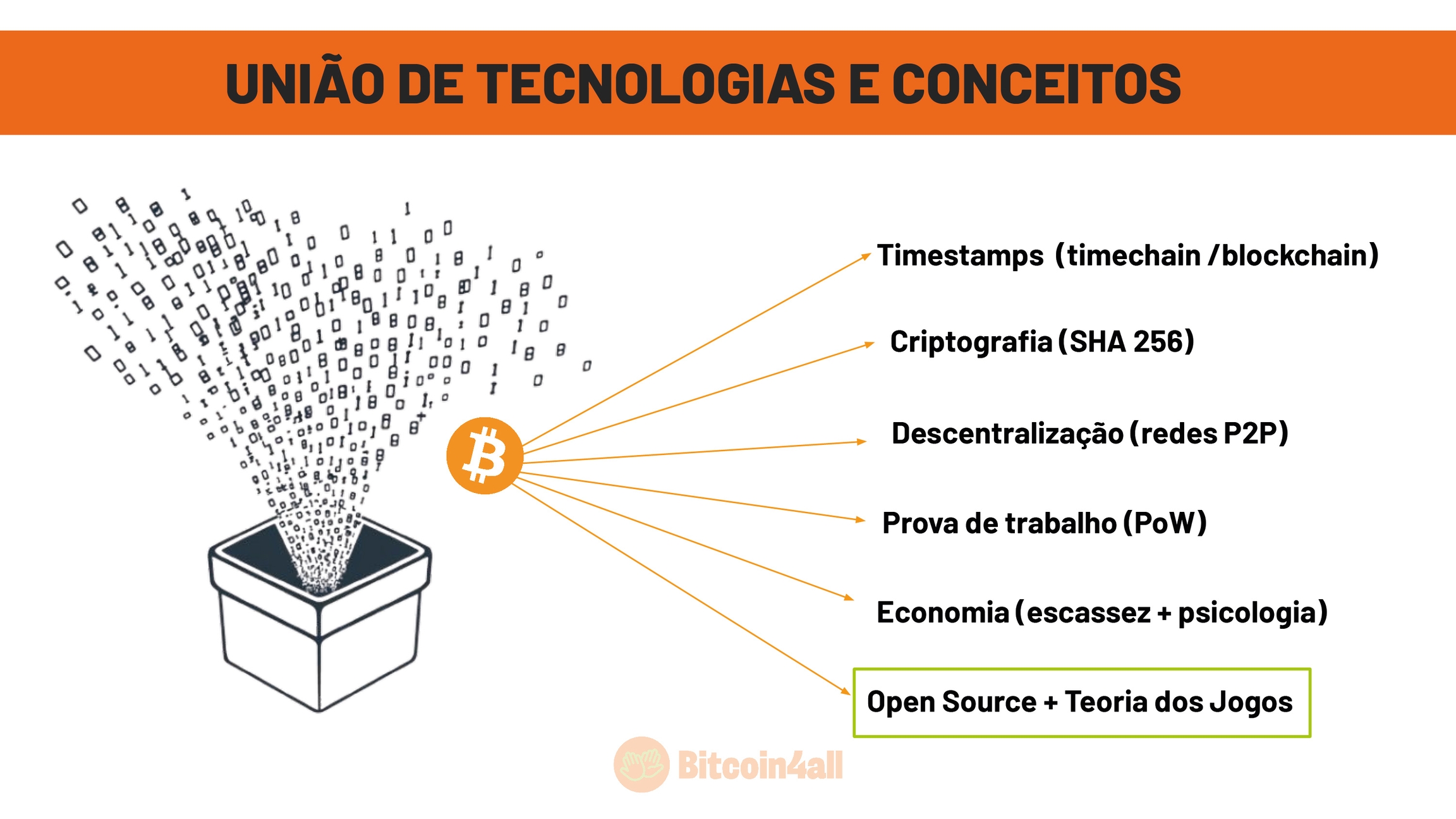

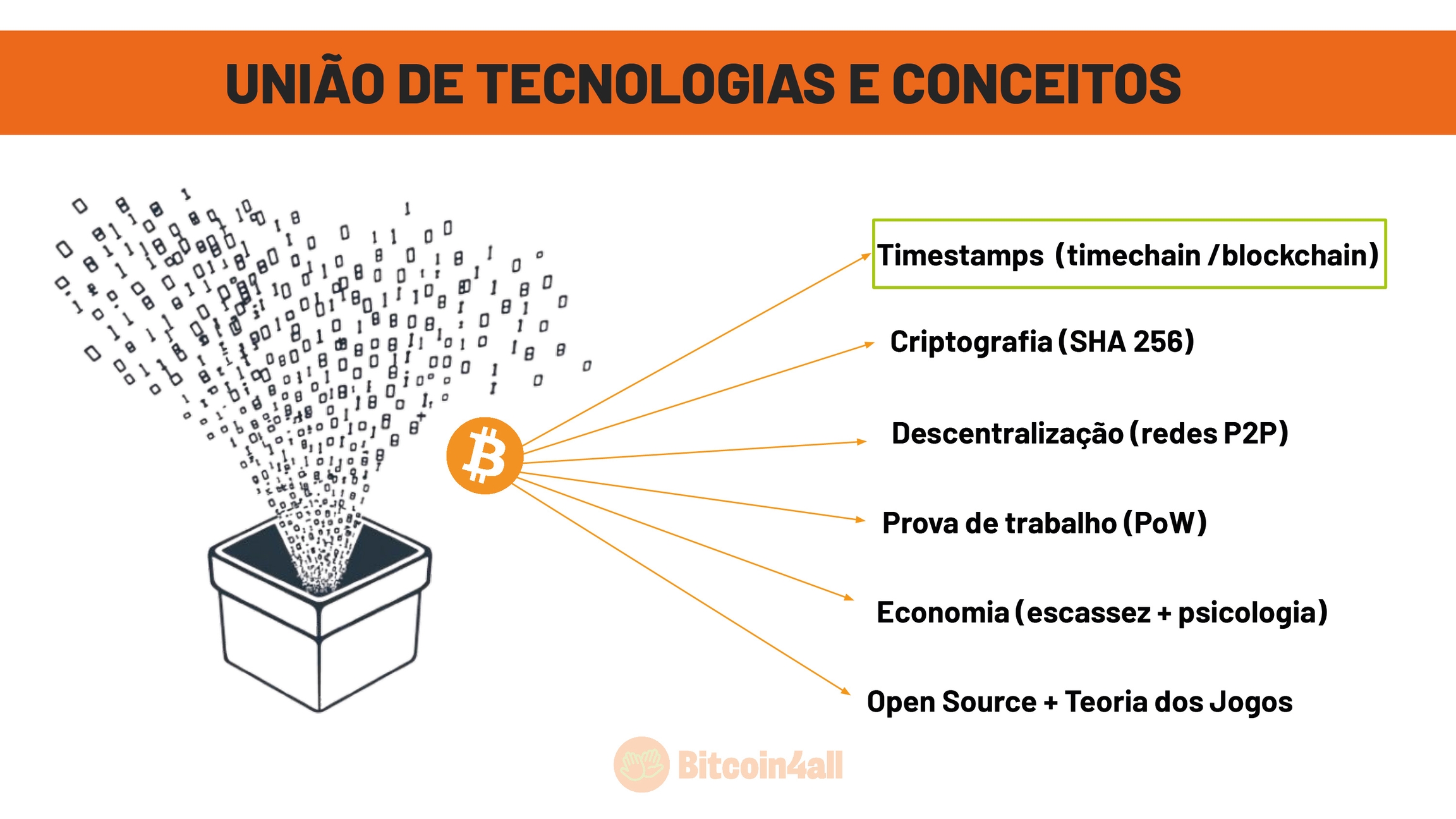

As you saw in class 1, Bitcoin is the combination of several technologies and concepts. Decentralization is what separates Bitcoin from any other invention in recent history.

And what has been happening in recent decades is the action of two technological forces acting at the same time: the decentralization and the dematerialization of things. Dematerialization began in the 90s with computers and smartphones, which condense and dematerialize various devices that we previously only knew in physical form. Radio, calendar, television, camera, calculator, fax, all of this in just 20 years was dematerialized and digitized to the palm of your hand, on your cell phone. It all became one.

Bitcoin continues this evolutionary and technological change by bringing both of these effects to the economy and to money. In other words, bitcoin decentralizes access to value for anyone from anywhere in the world without access restrictions and also dematerializes the banking financial system of branches, vaults, ATMs and safes. And if the internet has already decentralized information and changed the world, imagine what Bitcoin can do by decentralizing value and decision-making power. Besides dematerializing central banks, commercial banks and the properties of sound money.

Bitcoin can only do this because it is decentralized. Without decentralization, Bitcoin would be a company. It is decentralization that differentiates Bitcoin from everything else and provides immutability. If there is no one making decisions for other people, it means it is a network that is difficult to change. For any change to be made, almost all participants need to agree to change. And this is not easy at all, neither in Bitcoin nor in any system involving thousands of human beings making decisions. Decentralization is what guarantees the immutability of properties and that Bitcoin's rules will remain the same. It brings confidence that no one could monopolize or corrupt bitcoin authoritatively.

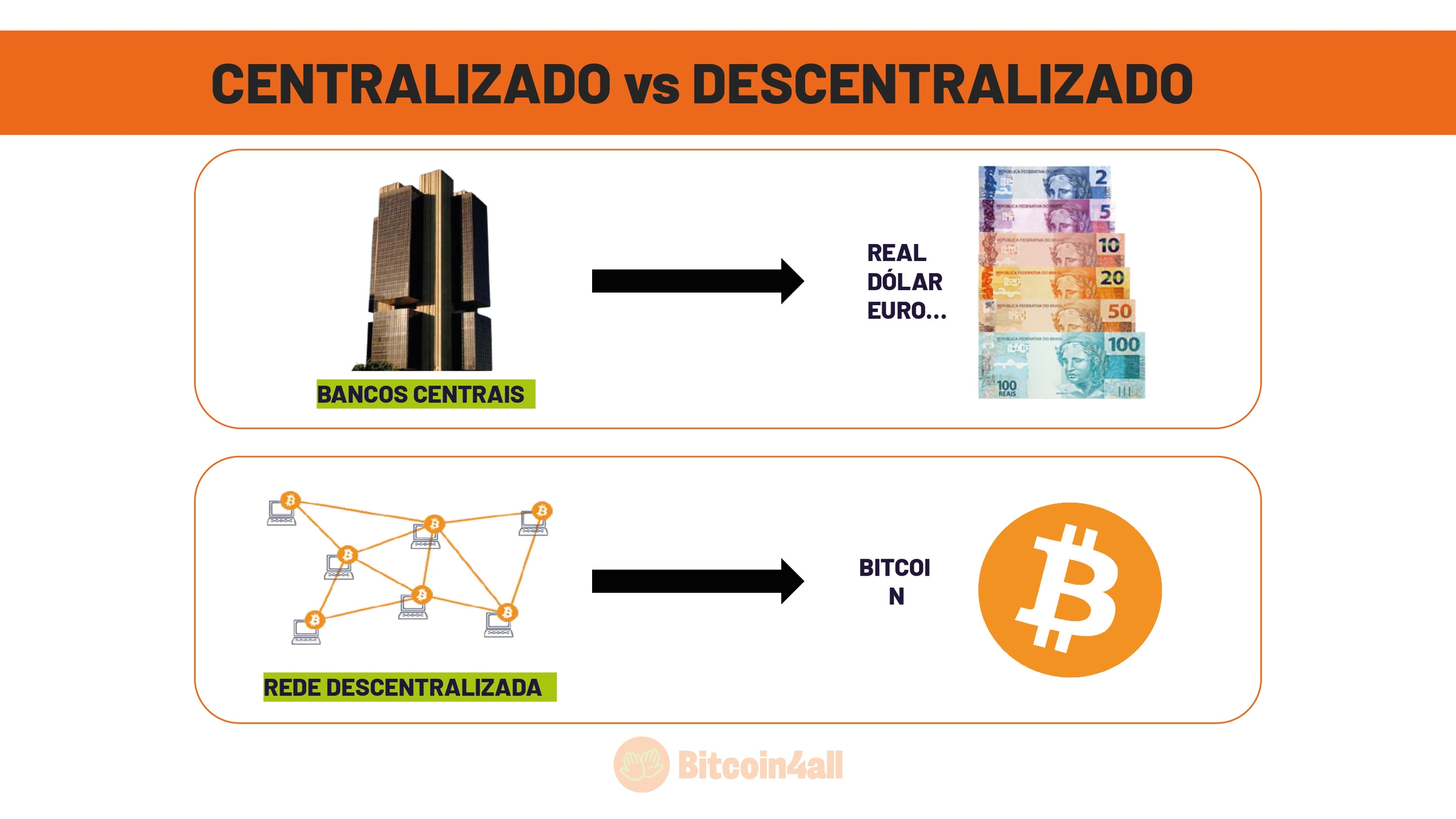

Bitcoin's decentralization happens because it is a P2P network, peer to peer. It is formed by computers that connect to each other and follow rules that everyone agrees on. There is no central server coordinating or storing data, as happens in centralized networks. It also means there is no single point of failure. If any computer connected to the network goes down, is destroyed or attacked, the network survives and continues to function because there are thousands of others performing the same function independently.

In practice, it means there are no intermediaries in Bitcoin. Each person can connect to the network without depending on anyone, without needing to ask permission and without the possibility of being prevented by third parties. Unlike fiat money which is centralized and where you depend on numerous entities, minister of economy, central bank director, payment institutions, mint, banks, etc. to have access to the system.

Central banks determine monetary policies and you don't have the option of not following the rules, you are forced to follow them. That's where the expression "legal tender" comes from. Commercial banks give access to the system. To participate you need to ask them for permission and, if you don't meet the requirements, you may not have a bank account or they may even close your account.

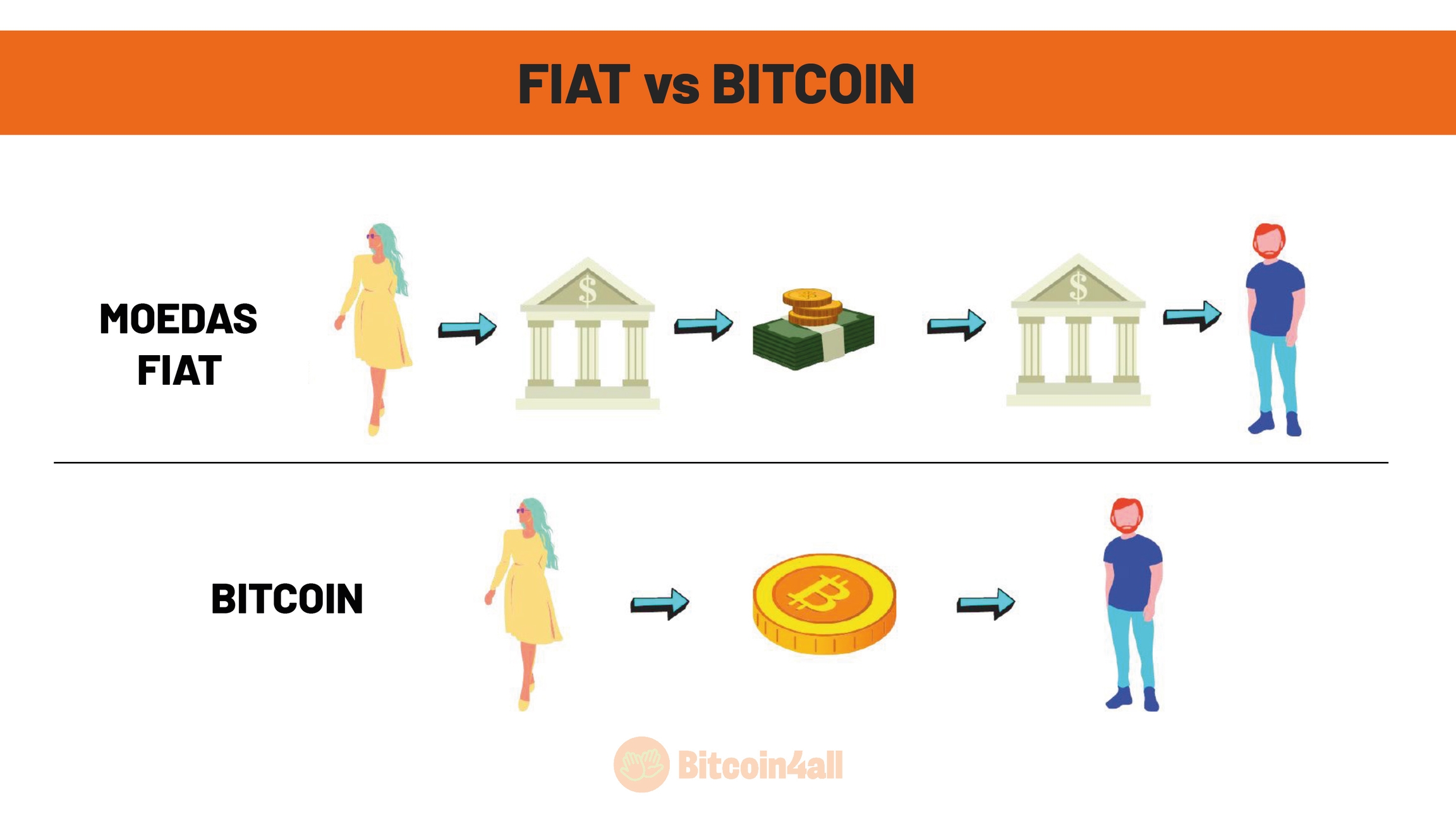

Another big difference is when making transactions.

Currently, when you make a digital transaction, you have to ask your bank to send a value to another person's bank, and then that person's bank deposits the value in the corresponding account. In a transaction between two people using the fiat banking system, there is at least one intermediary, a bank, between two people. If these two people have accounts at different banks, then there will be two banks intermediating the transaction.

With Bitcoin it's like making a physical cash transaction, just like when you buy a product and hand the bills directly to the other person. With bitcoin you send the value directly to another person's wallet without necessarily going through any type of fiat intermediary or bank. Unless you want it to go through, that you choose to transact through exchanges for example, but it's a choice, not a mandatory route. This completely changes the way the financial system works, because today the fiat system depends on these intermediaries to transfer values online.

It was through cryptography, timestamps, P2P networks and a robust consensus mechanism that Satoshi Nakamoto managed to digitize the financial system as a whole, but without needing governments or banks.

The Bitcoin network is formed by the code, the miners and the nodes. The code is a set of rules in the form of computational codes and cryptography that guide participants to coordinate with each other. It determines how records will be made and how the bitcoin network should work. The code is public and anyone can suggest modifications, audit to find bugs and even copy it. It is this code that is difficult to modify and monopolize, it is run by thousands of participants and to modify it validly it is necessary for practically the entire network to agree to run a modified version.

You can check out Bitcoin's github, where developers debate updates and where you can also contribute if you want. I'll leave the Github link here below the class. The code works through software and the most used is Bitcoin Core, an implementation of the original version created by Satoshi Nakamoto.

The miners are the participants who propose the blocks, insert the transactions and defend the network from attacks through computational power. They are the first to receive Bitcoin from the network for each block mined.

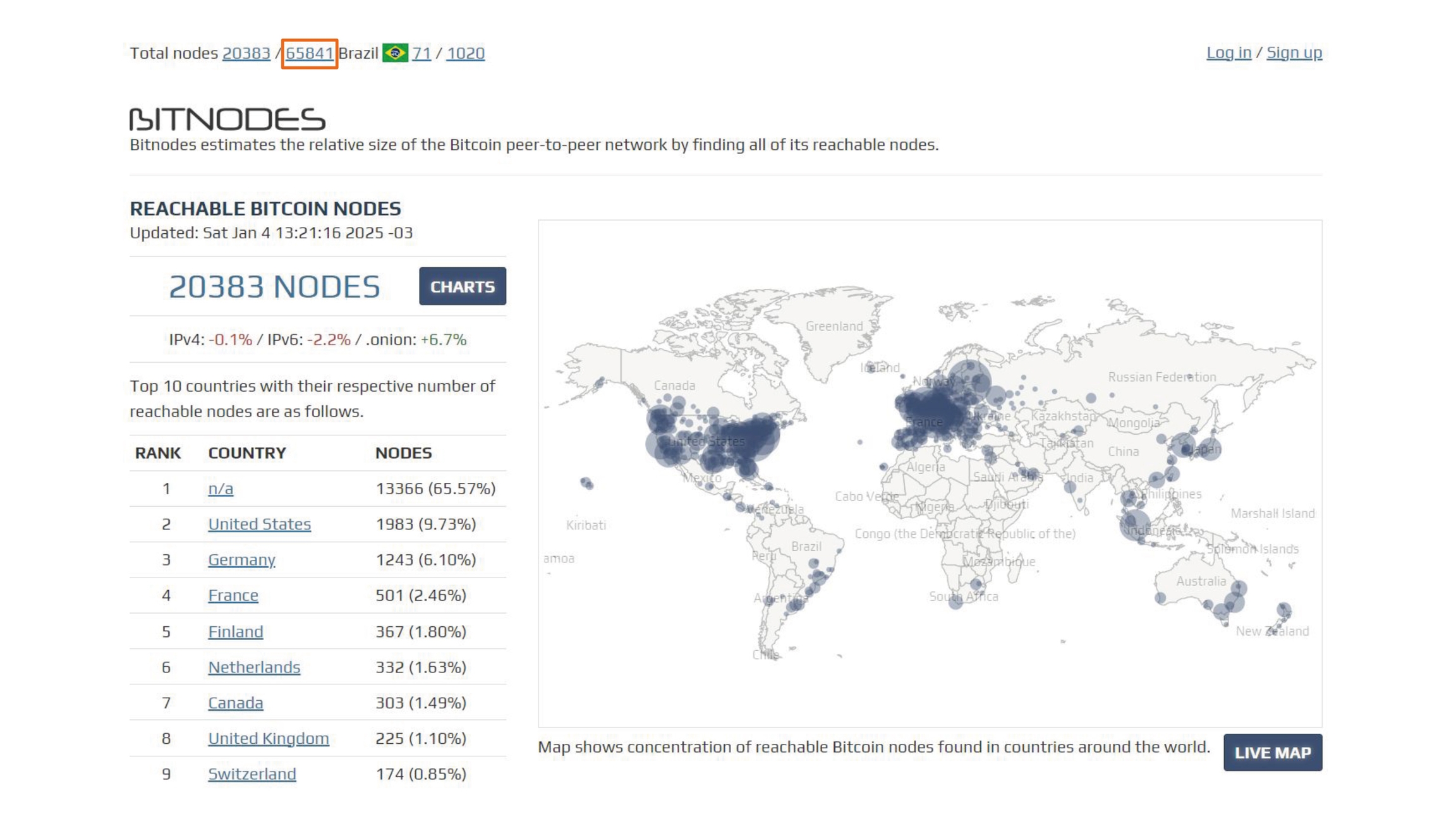

And the third type of network participant are the nodes. Nodes are common computers that verify whether miners are following the consensus determined by the code. Nodes are powerful agents of decentralization, because it is from them that anyone can have a copy of the Bitcoin blockchain on their own computer, decide which version of the code to run and be part of the bitcoin network with autonomy to send their own transactions without depending on anyone. In fact, if miners get together to attack Bitcoin, it is the nodes that have the power to prevent that attack from being effective. This has actually happened in the so-called blocksize war that happened in 2016.

According to the Bitnodes website, there are more than 65 thousand Bitcoin nodes operating globally and most of them, 65%, do not have an exact identified location. It is these thousands of nodes on common computers connected to each other that make the Bitcoin network the strongest, most resistant and accessible computational system for anyone anywhere in the world to verify. Anyone can run a node and the cost is low, you can even run a node on an old computer you have at home.

The nodes verify the records all the time. That's why the Bitcoin network's accounting is perfect, because the nodes constantly verify whether the transactions balance and whether the number of coins circulating is correct. It is a distributed record system, where the accounting always matches perfectly, this is also something powerful and unique.

Central banks do not allow you to look at their internal accounts or give your opinion directly in meetings. Central bank accounting is private and done behind closed doors. The population depends on data provided by the Central Bank and cannot independently verify or directly opine on monetary policies. The population doesn't even choose who will preside over the Central Bank! With Bitcoin, anyone can audit the network and suggest improvements, because it is freely accessible.

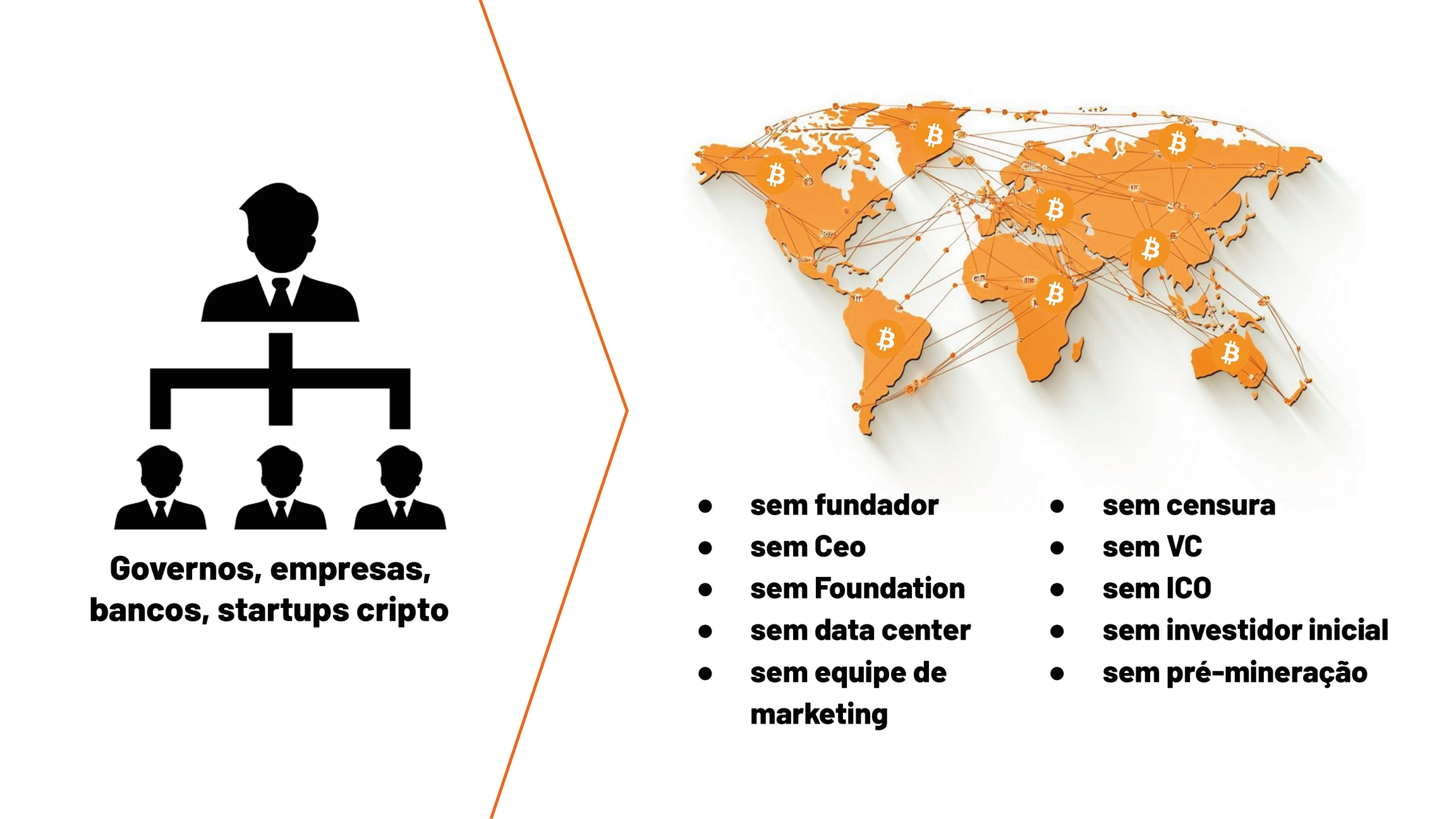

Centralized structures are hierarchical, like a company: there's a CEO, someone making decisions about the next steps, there's a marketing team, research and development team and they function through this hierarchy of power. Companies compete with each other to gain market share. Cryptocurrencies are like companies and compete with each other for market share by selling utility, as companies do.

Bitcoin is horizontal, it's collaborative, it simply exists and allows anyone to use and participate in the network. There is no one determining where the protocol is going and what the next update is. It is the collective of users, nodes and miners who define which versions of the protocol they will run without even agreeing with each other. That's why Bitcoin has no competitor, nothing works like it. Bitcoin embraces adversarial thinking and uses these individual incentives to strengthen the whole.

That's why Bitcoin is so resilient. There's no way to censor or prevent people from accessing it, even if they disagree with each other. Unlike banks that constantly close user accounts and change the rules constantly.

In fact, many protocols claim to be decentralized, but when you analyze them deeply they are the opposite: they are like companies. They have leaders, they have concentration of decision-making power, they are easily censored and would not survive hacker attacks or government censorship. Bitcoin has been constantly attacked and continues to run non-stop for more than 10 years because of this resilient and decentralized structure.

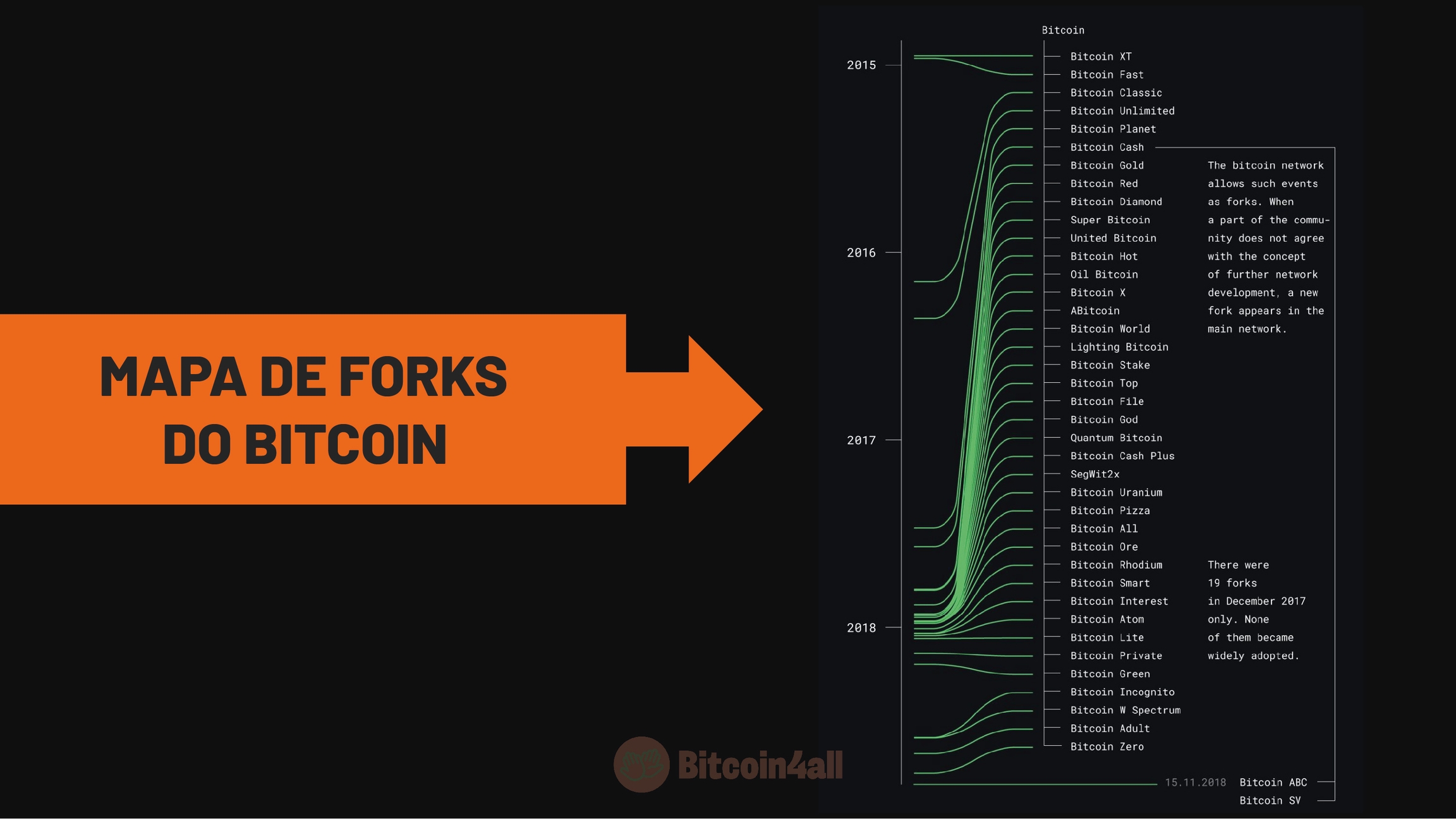

Even with hundreds of copies existing, none of them has managed to surpass Bitcoin, not even any other cryptocurrency that emerged later. This image shows the forks, the copies that have already been made of Bitcoin from 2015 to 2018. Many call themselves "the real bitcoin" and tried to steal narrative, visibility and liquidity, but none actually succeeded. No project can steal the properties and network effect that Bitcoin has. Any level of centralization is already a point of mutability, of monopoly of decision-making power and also a potential point of failure that can be exploited by attackers.

Satoshi knew from the beginning that decentralization was the key point of Bitcoin and one of the main reasons previous digital money projects didn't succeed. He even wrote in 2009: "a lot of people automatically dismiss digital currencies because so many companies have failed since the 90s. I hope it's obvious it was the centrally controlled nature of those systems that doomed them."

Bitcoin's decentralization is the result of a unique combination of factors that work together to protect the network. To compromise the system, an attack would be required that demanded extreme coordination, enormous financial resources and a colossal amount of energy. This almost insurmountable barrier is sustained by the practical application of game theory, which incentivizes participants to collaborate with each other to strengthen the network rather than try to hack or deceive each other.

In Bitcoin's game theory, collaboration is always more profitable than sabotage. Miners, validators and other participants have financial and structural incentives to act in favor of the network, since any attack attempt would be extremely expensive and, in most cases, useless.

Furthermore, for this collaboration to be possible and reliable, Bitcoin operates with total transparency. Its code is open source, meaning open and accessible to all, allowing continuous auditing and ensuring that no rule is changed without network consensus. This alignment between decentralization, economic incentives and transparency is what makes Bitcoin the most robust and secure monetary network ever created.

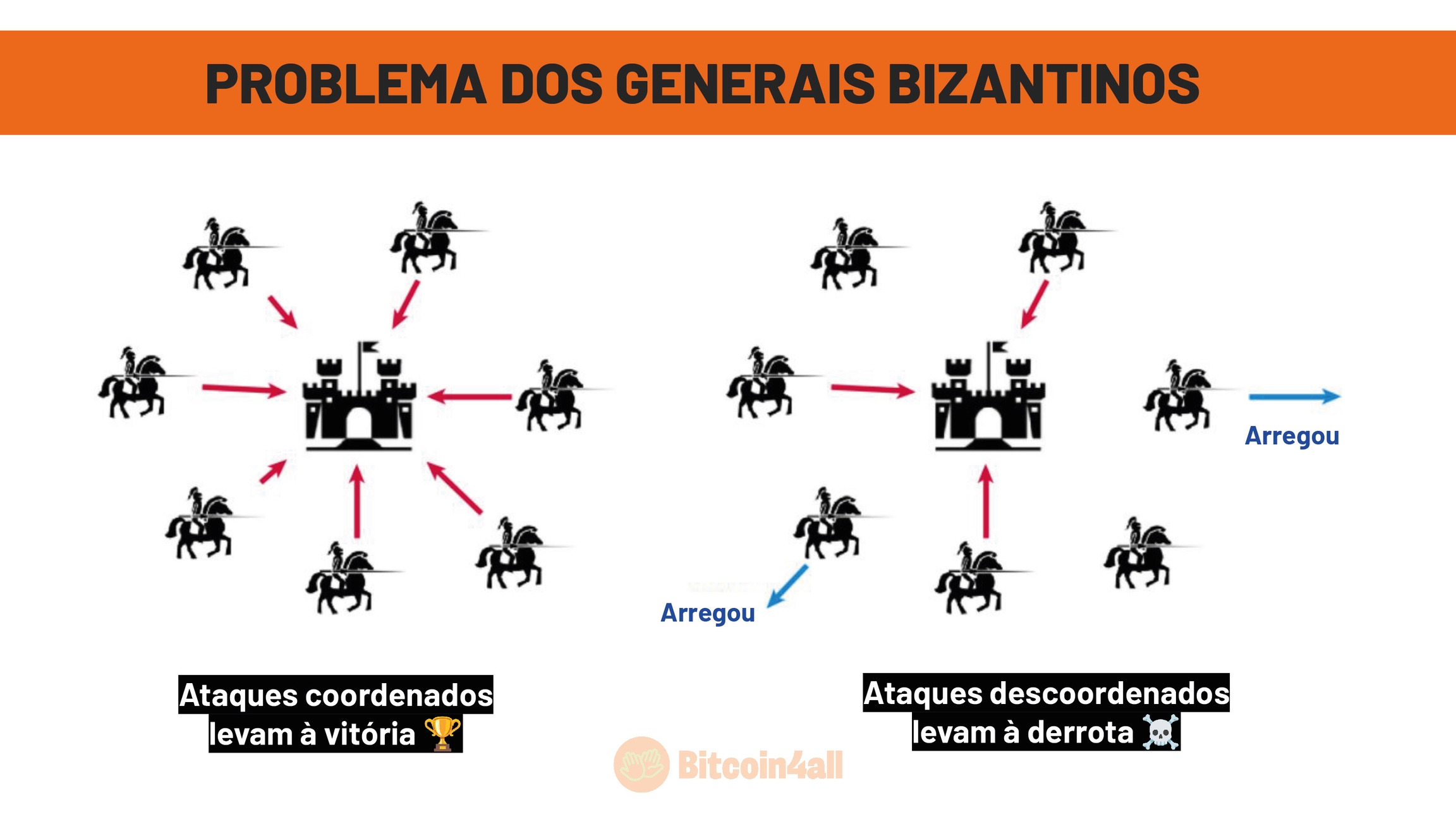

Satoshi managed to unite these points by solving one of the oldest problems: the Byzantine Generals Problem.

This analogy tries to answer, through a war situation, how computer systems could communicate in a decentralized way. Until before Bitcoin appeared, this problem had no answer.

Have you watched Game of Thrones? If you have, now imagine a scene of a city invasion like the one in the series. This city is called Byzantium and there are several generals wanting to attack this place. They surrounded the city and must decide together when to attack. If they all attack at the same time they win the battle because there was coordination. If they attack at different times, they lose because they became uncoordinated and susceptible to being attacked.

The generals have no secure communication channels with each other to create this coordinated action. First because they are in different positions around the city, and second because they cannot have guarantees that the message will arrive, the chances of a messenger being intercepted by the enemy is very high.

So, they need to find a way to communicate, to reach consensus on the right time to attack. The first general can start by sending an attack message at 9am, but he has no way of knowing if the messenger delivered the message or not. This uncertainty can lead the first general to give up attacking. Dilemmas like this caused many failures in digital currencies prior to Bitcoin.

Bitcoin managed to solve the Byzantine Generals Problem by having: complete coordination through Proof of Work, which establishes a set of network processing rules that coordinates everyone; through P2P networks that connect all participants to the same system; and through blockchain, a system of chained cryptographic records that everyone can verify without depending on any "messenger" from outside the system.

Through this system all the generals would be able to coordinate on the right moment to attack Byzantium without depending on third parties, in a synchronized, secure way and without anyone hesitating to attack.

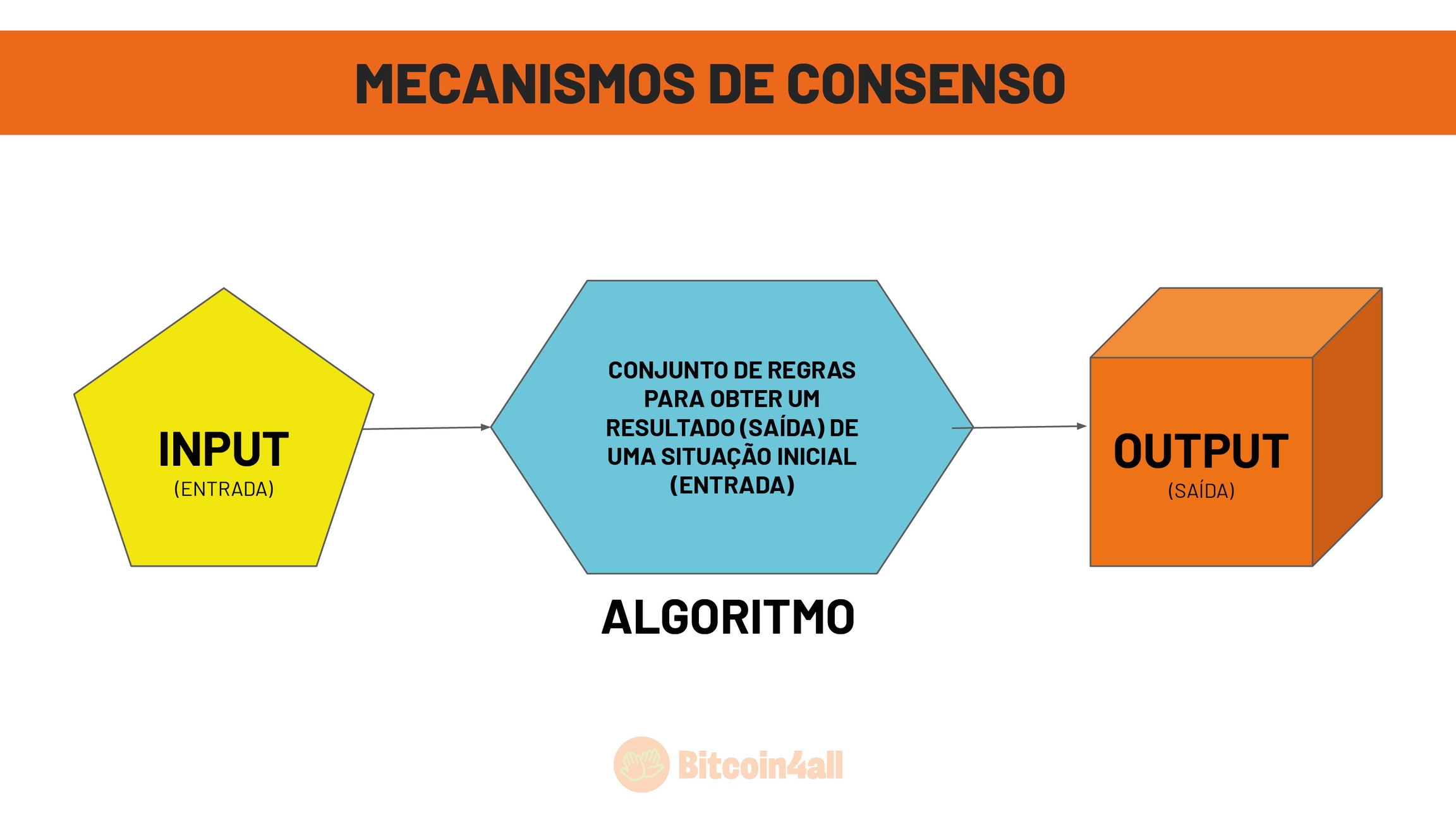

I just mentioned Proof of Work and consensus mechanisms, these terms are the rules that guide the protocol. They are algorithms that establish how the network will coordinate. This set of rules seeks, from an initial situation, an input, to reach a final result, an output.

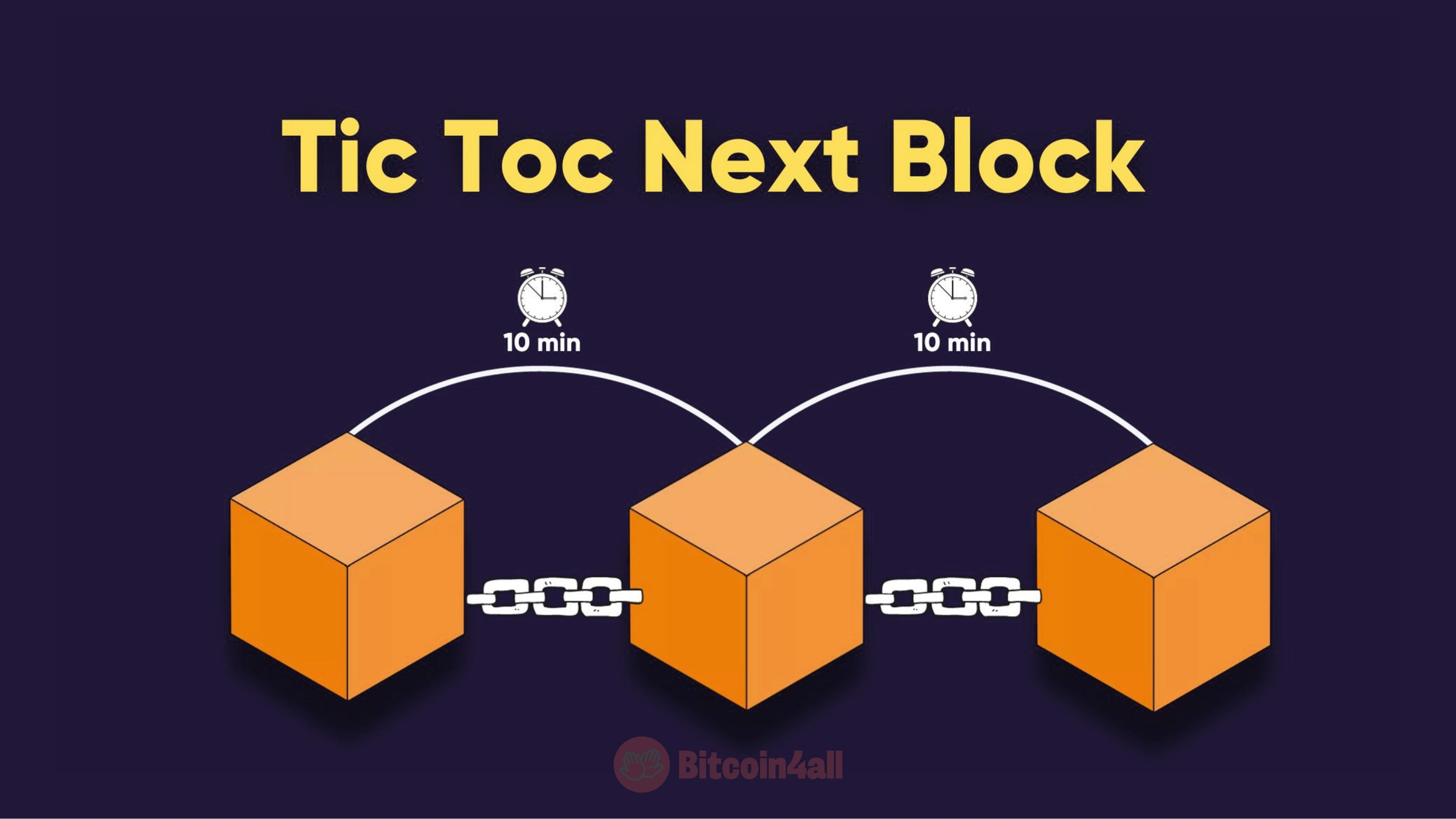

All of this works by recording information in a chained, distributed system that cannot be erased called blockchain. Satoshi used timestamps and timechain to describe this mechanism in the bitcoin whitepaper.

Some people say that blockchain is the true innovation behind Bitcoin, but this is the biggest nonsense. Blockchain is important, but alone and without other properties, it is just a slow, expensive database as centralized as a company's Excel spreadsheet!

Blockchain or timechain means chain of blocks. They are blocks of information linked to each other and that are processed by the network every 10 minutes on average. This means that many times it takes less than 10 minutes and other times it can take hours. It depends on the miners' computational power and the network difficulty.

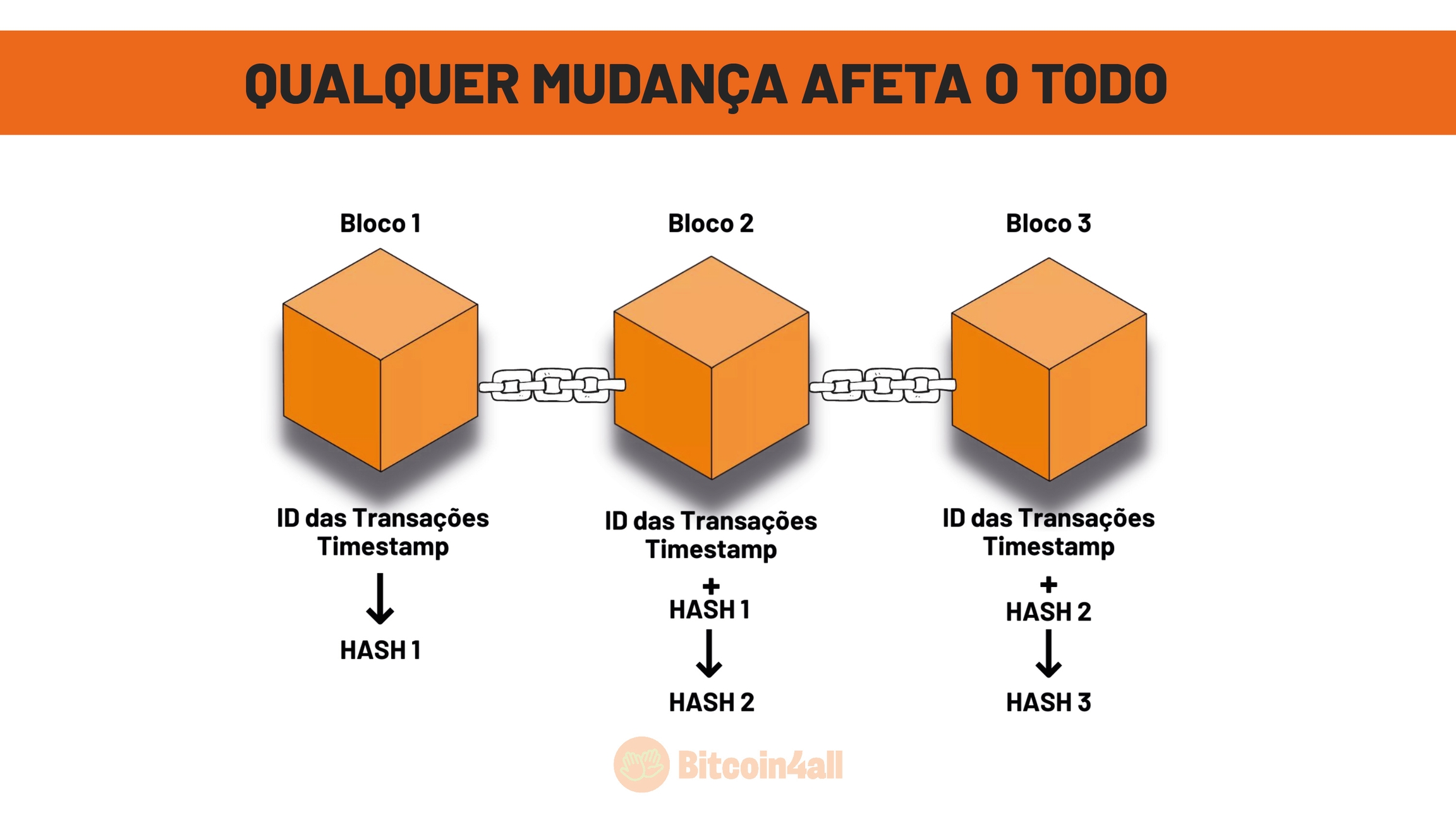

The immutability of records comes in the sense that you cannot remove or change the block in the middle of the chain. If there are 200 blocks and you try to delete or modify the one in the middle, the neighboring blocks will be affected, it changes the hash.

It's like digital stitching. If you pull the thread from the middle of a stitch, it distorts all the next stitches, isn't that right? With Bitcoin it's very similar. If any information is changed in a block, it ends up distorting all the following blocks.

So, let's suppose we're looking at the Bitcoin blockchain right now. Each mined block contains information about the financial transactions made on the network and about the block itself where they were recorded. But the network summarizes all these formations in a code called HASH. The Hash is the cryptographic phrase that summarizes all the information inside the block of information. It is from the Hash that the chaining happens.

After creating the Hash 1 of block 1, it will be inserted together with the content of the next block, block 2. It will be mixed randomly and will form Hash 2.

Hash 2 summarizes all the content of its block and also of the previous block, because Hash 1 was inserted inside the content of block 2 and so on.

Hash 3 will be the cryptographic summary of block 3, which contains the hash of the previous block 2. Through these hash functions is how the network chaining happens. That is, the following blocks will always have a summary of the previous blocks. This is how the information is always correlated.

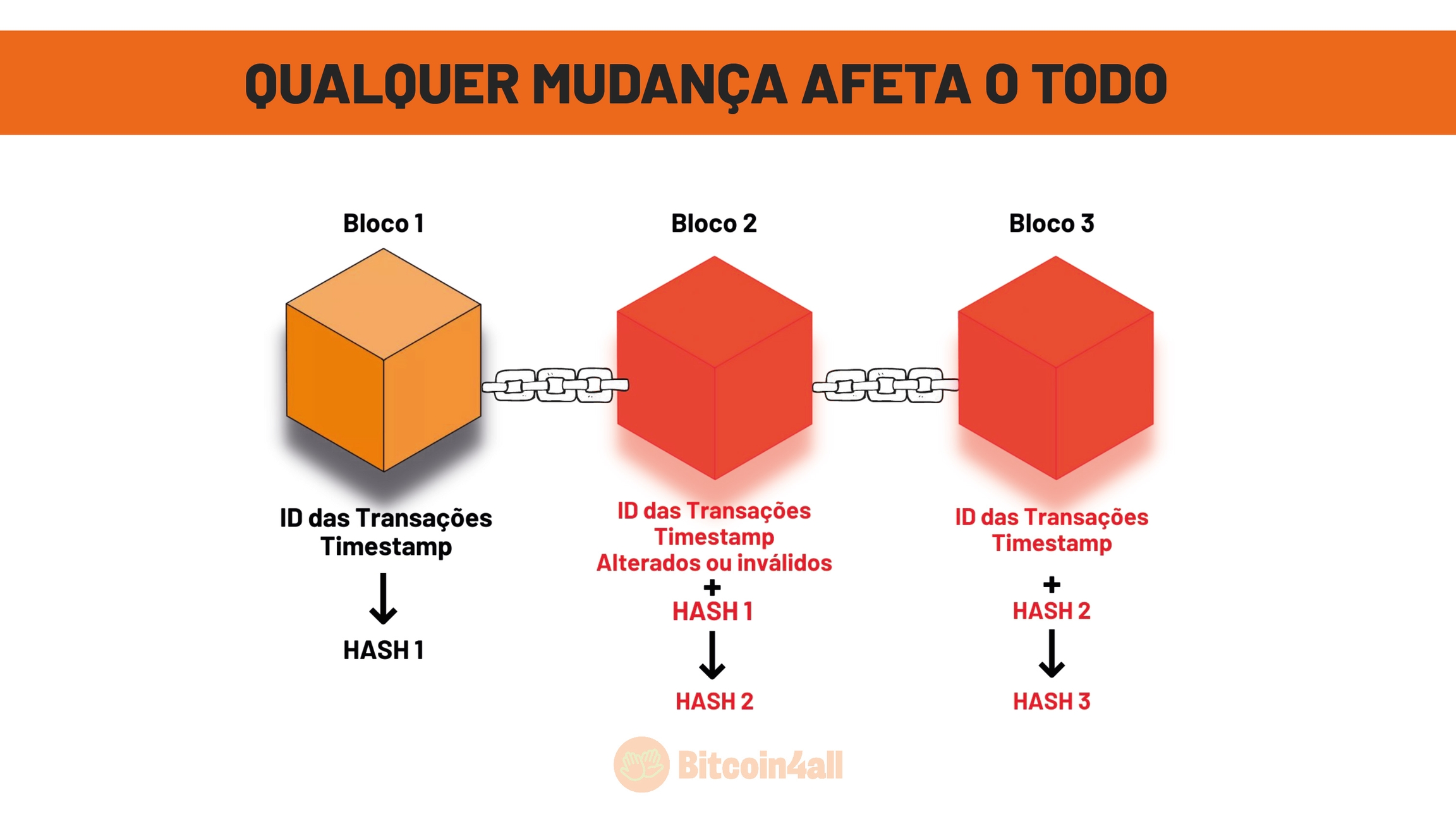

It is because of this chaining of information that the network is always confirming everything before mining the next block. So, if anything changes in block 1, the hash of all the following blocks also changes. If you change a comma, a space, a letter, anything, it already changes the Hash. If something is altered after being recorded on the blockchain, the miners or nodes that verify the network will identify the alteration through the hash and will not accept that information as valid.

This mechanism makes it absurdly easy to verify if there has been any attack on the transaction history while making it very difficult to effectively edit the past of the records. This is because both nodes and miners have copies of the bitcoin blockchain, if any information from the past is changed and doesn't match the copies that exist on their computers, they will be easily identified and will not accept that block as valid.

This is one of the constant verification factors that makes the Bitcoin network very secure and difficult to "trick" and hack. It is a network that manages to decentralize trust, because everything is correct, nothing has been altered. All information matches. This ease of verification and difficulty of manipulation is what makes the records on the Bitcoin blockchain immutable.

Still, if someone decides to modify the way the network works, that person can cause a fork.

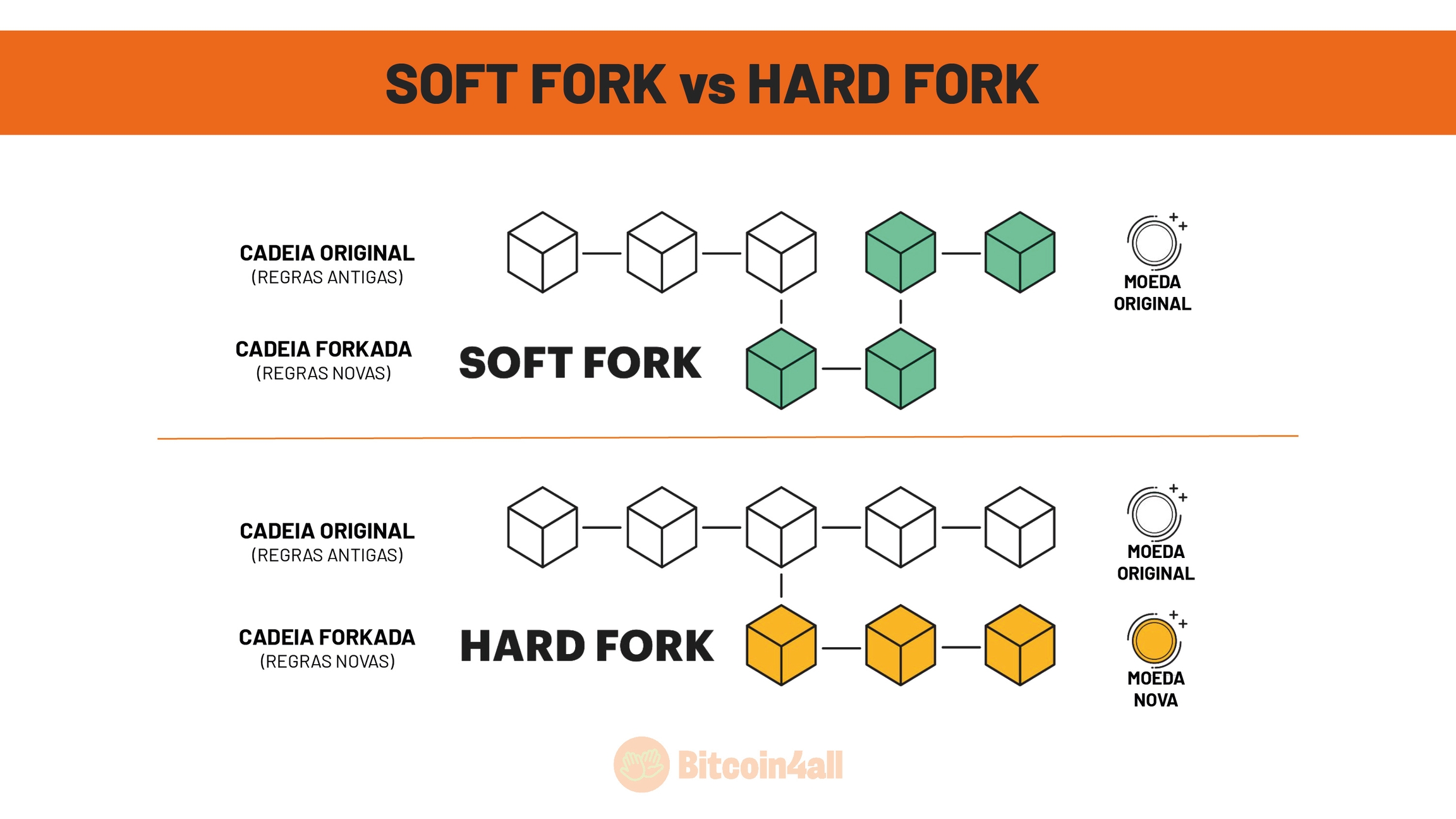

Blockchain version updates are called forks. There are two types of updates: soft forks and hard forks.

Fork comes from branching and that's why you'll see images of forks when someone talks about forks. Forks are different versions of the initial rules.

So what's the difference between these two types of forks, or rather, bifurcations?

Soft forks are when the network makes an update so that both those who run the old version of the code, the software, and those who run the new version can coordinate. It is a backward-compatible, optional fork that does not change the consensus mechanism. It remains the same network and the same currency but with some different details in the versions.

Hard forks are when radical updates are made, to the point of changing the protocol's consensus and those who run the old version cannot coordinate with those who run the new version. Old users cannot participate in the new network if they don't update. As a consequence, a new currency and a new network is created. This type of update forces users to update to the new version.

Bitcoin does not do hard forks, only soft forks. Because hard forks are centralizing forces, they exclude users who may not agree with the new version and end the network's immutability. Hard forks are more frequently observed in other cryptocurrency protocols and in private blockchains of companies.

Well, in this class we started to dive into how Bitcoin works, but this is just a part, there is much more content for you to learn. Absorb this knowledge, give your brain a break and when you're ready to continue I'll be waiting for you in the next class.

📢 Share this lesson!

Twitter LinkedIn WhatsApp Telegram

📈 Your Course Progress

Class 4 de 10 (40% completo)

Last updated